PRI Assessment Report 2025: Excellence Confirmed

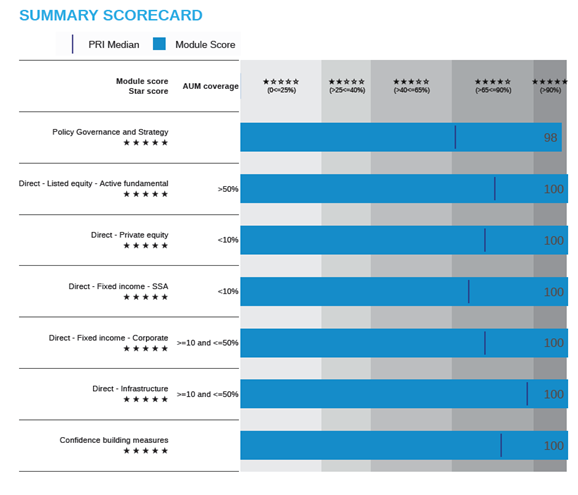

In 2025, Mirova once again achieved the highest possible score (★★★★★)[1] across all modules assessed by the Principles for Responsible Investment (PRI). This consistency reaffirms the strength and maturity of its responsible investment approach, while highlighting significant progress in governance, transparency, and ESG risk management.

Outstanding Results and Notable Progress

The 2025 PRI assessment recognizes Mirova for exemplary performance across all key modules—governance, listed equity, private equity, fixed income, infrastructure, and confidence-building measures. Each of these modules received the maximum five-star rating, a rare achievement in the industry.

Beyond this consistent high performance, Mirova recorded remarkable progress on several critical indicators:

- Governance and ESG responsibilities: A perfect score of 200/200, reflecting strengthened roles and responsibilities.

- Transparency and external reporting: A score of 200/200, illustrating enhanced communication and transparency with stakeholders.

- Post-investment ESG risk management: Strong improvements across listed equity and fixed income, demonstrating a more robust approach to monitoring risks after investment.

- Thematic bonds: Maximum scores on impact bond integration and transparency, in a context where the industry median remains at zero.

A Solid Lead Over Industry Standards

Across key dimensions—governance, transparency, and ESG integration—Mirova stands out for an approach that consistently exceeds current market standards. This leadership is driven by a commitment to advancing responsible investment practices across the industry and is reflected in:

- A strong transparency framework (voluntary reporting, proactive publication of policies and voting records)

- Active engagement and advocacy through public consultations and market working groups

- An advanced climate strategy (<2°C alignment, strict fossil fuel exclusions, proprietary methodologies)

- Recognized leadership in environmental and social impact bonds

As a result, Mirova ranks among the top performers in Europe and globally, with 100% of assets under management covered by a responsible investment policy, and more than 60% of funds holding a label.

In 2025, Mirova confirms its position as an international reference in responsible investment, thanks to a rigorous, transparent, and innovative approach, and strong leadership on governance, climate, biodiversity, and social impact

As a PRI signatory since 2013, Mirova is committed to adopting and implementing the Principles, assessing their effectiveness, and contributing to their evolution over time.

Below you will find the full assessment report, which covers:

- Our general investment and management policy

- Our listed equity activity

- Our fixed income activity

- Our voting practices

- Our unlisted energy transition infrastructure activity

The report does not cover:

- Natural capital

- Social impact investing

- Private equity

Sources for all figures: PRI Assessment Report 2025

[1] References to any ranking, award, or label do not guarantee future results for these awards, the fund, or the manager.

Mirova is pleased to announce the signature of framework agreements with BeZero Carbon & Sylvera, two of the world’s leading providers of independent carbon credit[1] ratings. These partnerships mark a new milestone in Mirova’s efforts to promote high-integrity voluntary carbon markets, building on more than a decade of investment in nature-based solutions and climate-positive projects.