Ideas

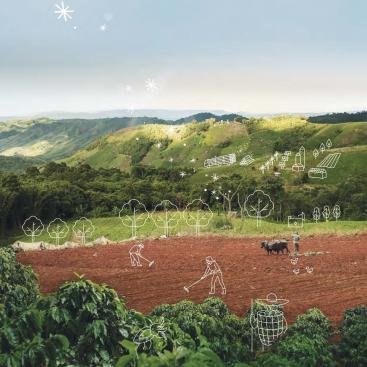

Forests cover almost a third of world land surface, on a decreasing trend as reforestation notably in the West and in Asia does not compensate local deforestation, in South America and Africa. But the rationale for forest expansion is strong, and developing wood-based productions can contribute to meeting some global challenges in various ways. In this context, properly designed and well managed forest plantations should be considered in impact-oriented investment universes, to support the development of a sustainable economy.

The world was alerted to climate and environmental issues more than 30 years ago by the IPCC1, and governments took measures to deal with these subjects more than 10 years ago, with the goal of reaching carbon neutrality and thus limiting global warming to 1.5°C2. And yet we are far from this target: the UN published a report in September 2021 stating that the world is on a catastrophic trajectory headed towards 2.7°C of global warming5. It has therefore become a necessity to undertake an industrial and environmental revolution to accelerate the environmental and energy transition. Through green and sustainable bond issuances, investors can contribute to the low-carbon transition while making a twofold impact: financial and environmental. Such is the purpose of the Mirova Global Green Bond3 strategy.

Understanding the markets, Investing, Engaging in dialogues, Measuring Impact... Read the new issue of Mirovα: Creating Sustainable Value

Discover the Althelia Climate fund impact report for 2020.

Discover the 2020 Althelia Sustainable Ocean Fund Impact Report.

Discover the first impact report for the LDN Fund.

Understanding the markets, Investing, Engaging in dialogues, Measuring Impact... Read the new issue of Mirovα: Creating Sustainable Value

We believe that more than ever, green bonds are the focus of attention and the curiosity they are arousing is equalled by the questions they have raised. These instruments, which are geared towards "green" projects, have emerged as a market segment of their own at a time when questions about the integrity and sustainability of investments are becoming increasingly pressing.