News

Investing in Sustainability? Yes but how. Learn about what happened at Mirova during Q1 and Q2 2020.

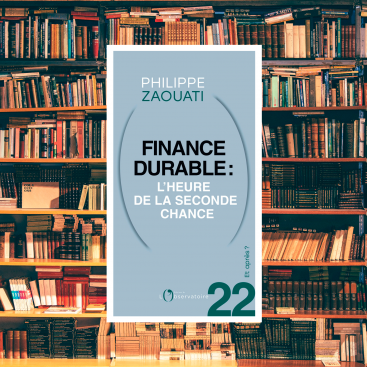

Éditions de l'observatoire presents a collection of digital works that anticipate the major themes of the world after the coronavirus. Philippe Zaouati, CEO of Mirova and a leading figure in green finance in France and Europe, has written one of these books, entitled: Finance durable : l'heure de la seconde chance (Sustainable finance: time for a second chance).

The blended finance vehicle will mobilize additional capital for sustainable agriculture and forest protection.

30 investors representing more than €6 trillion call for concerted and transparent creation of impact measures related to biodiversity.

Plastics For Change (‘PFC’), a company who has developed the world's first Fairtrade verified recycled plastic supply chain, announces today the closing of a US$2million investment, led by Mirova1.

Mirova announces its support to the French agtech start-up nextProtein, via the Althelia Sustainable Ocean Fund1. The start-up, which produces feed raw materials and insect-based fertilizers, has obtained €10.2 million in financing to increase its production and continue to innovate in this sector.

For the fourth year in a row, Mirova Natural Capital, the London-based subsidiary of Mirova fully focused on investing in natural capital, is honoured to be among the ImpactAssets 50 (‘IA 50’) list.