Energy Transition Infrastructure OECD

Investing in energy transition infrastructure offers investors the opportunity to align with global sustainability goals while diversifying their portfolios and achieving stable, long-term returns through predictable cash flows from renewable energy projects. As supportive policies and consumer demand for clean energy rises, these investments not only mitigate climate risks and avoid stranded assets but also position institutions at the forefront of technological innovation in a rapidly evolving market.

An opportunity for value creation over the long term

At Mirova, our mission is to empower institutional clients with opportunities for long-term value creation while actively supporting the decarbonization of developed economies.

With over 20 years of experience in structuring and managing energy transition funds, our investment team leverages extensive industry expertise with rigorous ESG analysis from Mirova’s Sustainability Research team, striving to develop investment solutions that meet investors needs by focusing on value creation and delivering positive environmental and social impact.

Key Figures

assets under management

of energy transition infrastructure funds

energy transition projects financed in 19 OECD countries

Why invest?

A ROBUST INVESTMENT THEME

- Portfolio diversification: By investing in tangible assets, investors can diversify their portfolio with steady, low-volatility cash flows that are less influenced by business cycles and capital market fluctuations.

- Attractive yield potential: In today’s low-interest-rate environment, renewable energy offers compelling risk-adjusted returns.

- Contributing to decarbonization: Institutional investors can engage in significant investments needed to achieve the Paris Agreement's 1.5°C target, requiring $1.9 trillion over the next decade for 1,000 GW of renewable power deployment

A FAST-EVOLVING INDUSTRY

- Increasing competitivity: As the cost of production continues to decrease, the clean energy sector is becoming increasingly competitive, allowing renewables to stand shoulder to shoulder with traditional energy sources.

- Innovation-driven opportunities: Innovative solutions are tackling challenges in energy transmission, distribution, and storage, making it easier to integrate renewable technologies into the grid.

- Cash flow predictability: Plus, established renewable energy technologies provide predictable cash flow.

A WIDE RANGE OF INVESTMENT OPPORTUNITIES

Involved from the very beginning in the financing of renewable-sourced energy production infrastructures, Mirova has a unique perspective on this market, contributing to projects that are new, whether in terms of technology, maturity or geography.

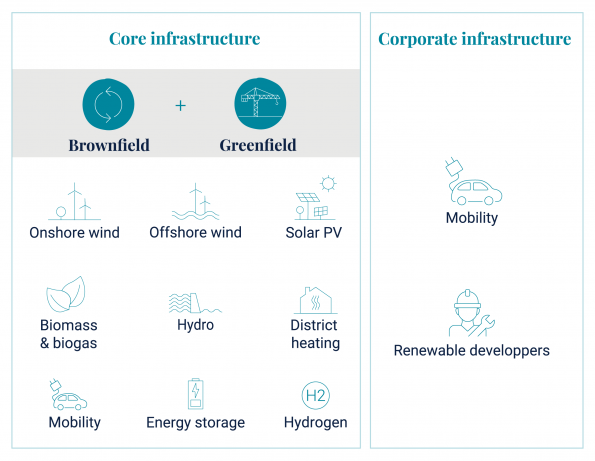

By leveraging our deep expertise in the renewable energy sector and our extensive network of partners, we have built a robust investment platform that covers the entire energy transition landscape:

- Mature infrastructure: Since inception, we have been at the forefront of the energy transition, financing the development of new renewable energy production capabilities and investing in established projects utilizing proven technologies such as photovoltaic solar, wind, and hydroelectric power.

- Innovative infrastructure: Our comprehensive approach also includes innovations in storage, biogas, hydropower, hydrogen, energy efficiency and electric mobility on a global scale, ensuring you have access to diverse and impactful investment opportunities.

AN IMPACT-DRIVEN APPROACH

Contribution to the UN SDGs (Sustainable Development Goal): We conduct a thorough pre-investment analysis to assess each investment opportunity's contribution to the United Nations Sustainable Development Goals (7, 9, 11, 13).

Thorough evaluation method: Our evaluation seeks to measure the contribution of each investment opportunity to advancing the UN’s Sustainable Development Goals. To carry out this assessment, Mirova has developed a methodology based on four key principles:

- A positive impact/residual approach

- A life cycle perspective

- Targeted and differentiated questions

- A qualitative rating scale

ESG action plan

We include an ESG action plan in the transaction documentation for most supported companies and projects. This plan outlines key areas for improvement in sustainable development and is developed in collaboration with project management to ensure its relevance, feasibility, and effective implementation.

One step beyond: Mirova also enhances its impact and contributes to the transition to a more sustainable economy by:

- Maintaining an ongoing dialogue with each individual project or company we support in order to encourage continuous improvement of practices,

- Advancing the state of knowledge and expertise in the area of sustainable development both internally and collectively – particularly by supporting academic and applied research (More information)

- Promoting the development of sustainable finance by being an active participant in professional organizations and through advocacy,

- Strengthening the importance of impact at Mirova through innovative initiatives and commitments, such as incorporating ESG criteria into variable compensation for management teams

- Supporting philanthropic activities (More information)

1Source: International Renewable Energy Agency (IRENA)’s Global Energy Transformation Report: A roadmap to 2050