Artificial Intelligence: Aligning the Digital Revolution and Ecological Transition

Position Paper

Let’s make AI an accelerator of transitions

Artificial Intelligence (AI) is redefining our world at a breathtaking speed, profoundly transforming economies, modes of design and production, and thus industries and society as a whole. Like the internet, it forms a powerful engine of innovation and productivity, the full consequences of which are still difficult to measure. In businesses, the use of this technology is set to become widespread, with likely impacts on profitability and a modification of business models. This technological revolution raises major issues in terms of ethics, environmental impact, social implications, and governance. As the adoption of AI accelerates, it is imperative that its development and use are framed within a sustainable and responsible approach.

At Mirova, we see AI not only as a powerful lever for economic transformation but also as a crucial tool to accelerate the transition to a more sustainable model. Our approach is based on two convictions that guide our commitment.

First, we believe in the convergence of the digital and ecological revolutions ("AI for Sustainability") and in the ethical and transparent use of this technology to ensure responsible development ("Sustainable AI").

The notion of sovereignty is also important: biases in the construction of models and their uses can lead to significant repercussions on economic, social, and even geopolitical decisions, thus reinforcing dynamics of dependency and injustice. Ensuring a rigorous framework for the design and governance of these models is therefore a major challenge to guarantee AI aligned with the general interest.

These axes structure our vision. As the Summit for Action on Artificial Intelligence takes place on February 10 and 11, 2025, in Paris, this publication aims to present our perspective on these issues by showing how a sustainable and responsible approach to AI can help address current societal and environmental challenges and create long-term value.

Context and Issues

AI is establishing itself as a strategic tool to address environmental and social challenges as its capabilities evolve. AI technologies already have concrete applications that enable numerous advancements, particularly in the fight against climate change, the preservation of biodiversity, and social progress.

However, these opportunities come with major challenges. For instance, the rapid rise of AI technologies generates unprecedented exponential energy consumption. The manufacturing of the components necessary for its development, particularly semiconductors, relies on the extraction of critical minerals, the exploitation of which can have detrimental consequences for biodiversity and local communities, and whose effects we have yet to fully measure. Automation, driven by AI, is transforming the world of work by rendering certain jobs obsolete and exacerbating inequalities, with some roles being more heavily impacted than others across the entire value chain.

AI also raises ethical and sovereignty questions due to the inherent biases in model design and their use. The opacity of algorithms and the concentration of AI technologies in the hands of a few large companies pose crucial governance challenges. Ensuring an ethical and transparent development framework is therefore fundamental to prevent AI from exacerbating dynamics of inequality and technological domination.

A responsible investment approach that takes into account the impacts of AI is essential, both environmentally and socially. Supporting companies that develop technological solutions aligned with the Sustainable Development Goals (SDGs), while committing to minimizing their environmental footprint and promoting quality ethical and social practices, is a pillar of this strategy. AI should not only be a vector for growth but must become a tool in service of society while respecting planetary boundaries.

« AI for sustainability »

Harnessing Innovation for Transitionand Long-Term Performance

The disruptive potential of AI is immense, yet it embodies a fundamental duality: it can either contribute to accelerating the climate crisis and deepening inequalities or serve as a strategic lever to address these issues. At Mirova, we believe that the future of the economy lies in the convergence of the digital revolution and ecological transition. AI must be seen as both an opportunity for innovation and financial performance, and as a tool for sustainable and inclusive economic development.

We integrate this dual transformation into all our investment decisions and engagement strategies. We identify and support companies that develop AI solutions capable of addressing environmental and social challenges while maximizing their positive impact, such as improving energy network management, optimizing the use of natural resources, or enhancing biodiversity preservation.

A STRATEGIC LEVER FOR A SUSTAINABLE AND INCLUSIVE TRANSITION

A study from Columbia University already lists over 300 AI initiatives for climate and nature[1]. These initiatives primarily focus on forest and land management, agri-food, agriculture, and industry, with a geographical concentration in the United States and Europe. Thanks to its ability to process and analyze vast amounts of data in real-time, AI enables the anticipation of environmental risks and the adaptation of responses with unprecedented precision. Advanced solutions, such as the Earth-2 digital twins developed by Nvidia, allow for modeling the evolution of weather and environmental conditions, thus facilitating the adoption of effective adaptation strategies. Similarly, ecosystem monitoring increasingly relies on AI tools, particularly through satellites operated by Planet Labs, which provide high-resolution images of the Earth. Once processed, this data allows for real-time tracking of natural habitat changes and alerts on threats such as deforestation or ecosystem erosion. AI thus represents a tremendous opportunity to optimize the use of natural resources and reduce the ecological footprint of human activities.

AI also plays a crucial role in accelerating the energy transition. One of the major challenges of electrification lies in integrating renewable energies into electrical grids, as their intermittency hinders widespread deployment. AI facilitates the anticipation of production fluctuations and the adaptation of grid management, ensuring supply stability. Furthermore, AI enables better energy distribution management by adjusting the supply and demand for electricity in real-time, reducing waste and improving the reliability of electrical networks. In the field of infrastructure, digital twins play a central role in optimizing the management of physical assets. These technologies facilitate the maintenance of transport networks and hydraulic infrastructures by automatically detecting anomalies, thereby reducing operating costs and minimizing environmental footprints. In the construction and agriculture industries, AI can promote the design of more energy-efficient buildings and optimize agricultural practices to minimize the use of natural resources.

Beyond its application to environmental issues, AI is also proving crucial in addressing social challenges. In medicine, it is used to accelerate research through protein modeling and genome or DNA sequencing, thus facilitating the development of innovative treatments. In education, it offers the possibility of personalizing learning and alleviating administrative tasks. Finally, regarding financial inclusion, platforms like Kiva leverage advanced algorithms to optimize the matching between lenders and borrowers, increasing access to microcredit and thereby supporting the economic empowerment of the most vulnerable populations.

For investors, these innovations represent a unique opportunity to combine financial performance with a positive impact on the planet and society.

INTEGRATING AI INTO OUR PORTFOLIO MANAGEMENT PROCESSES FOR PERFORMANCE AND IMPACT

Mirova is already working on integrating AI-based solutions to maximize portfolio management and ESG analysis, while also advancing academic research for impact:

- Integrating AI into our ESG analysis models to optimize and enhance their reliability;

- Collaborating with partners who are already utilizing AI, particularly in the analysis of controversies;

- Supporting academic research initiatives aimed at leveraging AI to address major challenges in sustainable finance. For example, analyzing the credibility of companies' environmental transition plans and their compatibility with regulations, as well as studying the coherence and accuracy of information provided by companies regarding physical footprint measurements, can be facilitated through AI;

- Utilizing AI technologies to optimize the management of our assets related to forests, renewable energies, and sustainable infrastructures. The ability of AI to deeply analyze large volumes of often heterogeneous and unstructured data will allow us to maximize our capacity to finance projects that promote ecosystem regeneration and climate resilience.

AI FOR ENHANCED ASSET MANAGEMENT

AI can be a powerful tool for asset management companies, enabling them to refine their analytical capabilities, improve the identification of responsible investment opportunities, and ensure effective and transparent asset management. It is an undeniable asset in making sustainable finance more ambitious, going beyond financial optimization and operational efficiency gains.

Financial and non-financial data is at the heart of our business. AI provides unmatched analytical power for processing this information, making it faster and more accurate by identifying trends that traditional methods cannot capture. Through machine learning models, we can enhance the quality and relevance of our environmental and social assessments. These advancements, combined with the expertise of financial and ESG analysts, enable us not only to more accurately evaluate the sustainability of the companies we invest in but also to anticipate risks and identify weak signals that may influence the future of our portfolios. Additionally, AI allows us to extend our coverage to a greater number of companies, banks, and insurance firms that our managers are currently investing in or wish to invest in.

The integration of AI in asset management provides concrete solutions to improve the transparency and reliability of companies' ESG commitments. One of the major challenges facing sustainable finance remains the reliability of information and the fight against greenwashing. By cross-referencing various data sources and applying advanced analytical algorithms, AI can detect inconsistencies in companies' claims regarding their carbon emissions or environmental commitments. It will enhance the traceability of supply chains and play a key role in detecting controversies and monitoring upstream and downstream emissions (referred to as "scope 3"), which are still challenging to quantify today.

Finally, the applications of AI contribute to enhancing the tools for measuring environmental impacts. For instance, the combination of AI with satellite imagery and real-time geospatial data improves the monitoring of deforestation, the mapping of natural habitats, and provides a more nuanced assessment of the environmental footprint of infrastructures.

By integrating these technological advancements with our expertise, we are evolving our approach towards asset management that is both more efficient and more committed.

AI must be seen both as an opportunity for innovation and financial performance, and as a tool for fostering sustainable and inclusive economic development.

Attractive Opportunities Across All Asset Classes

AI is already reshaping transition industries, opening broader investment perspectives. We integrate the risks and opportunities related to AI into our dialogue with portfolio companies to help them enhance their positive impact. These opportunities extend across all our asset classes in both public and private markets.

In public markets, AI is revolutionizing energy production, healthcare, and agriculture. For example, in the energy sector, Vestas has filed more than a dozen patents for methods using advanced learning models to optimize wind energy production and improve predictive maintenance of its facilities. By adjusting turbine management according to weather conditions and identifying maintenance needs before failures occur, these technologies maximize clean energy production and extend the lifespan of infrastructure. In healthcare, Thermo Fisher leverages this technology to automate and refine medical image analysis, thus improving the accuracy of in vitro diagnostics and imaging tools. Finally, in agriculture, Trimble offers real-time analysis tools that optimize the use of natural resources and reduce environmental impact.

Regarding private assets, the share of investment opportunities incorporating AI as a lever for innovation has seen a remarkable increase within our impact private equity strategy pipeline, rising from 4% in 2022 to 17% in 2024[2]. his evolution reflects the growing power of AI as a driver of sustainable transformation.

For instance, the aerospace industry is benefiting from this revolution with companies like OpenAirlines, which use AI to combine data from aircraft black boxes with real-time information on conditions encountered during flights. The algorithm assesses fuel consumption efficiency and provides recommendations for upcoming flights. In the energy efficiency sector, Gridbeyond offers intelligent solutions that enable businesses to anticipate electricity demand and fine-tune their consumption to reduce their carbon footprint and generate operational efficiency gains.

« Sustainable AI »

For Ethical, Transparent, and Sustainable Innovation

While AI presents significant potential to support ecological transition, it also poses challenges that cannot be ignored. Its development must be regulated to prevent it from becoming a worsening factor in environmental and social crises. The deployment of AI inevitably raises major questions regarding ethics, transparency, and governance. Its impact on work models, data management, and algorithmic biases necessitates a rigorous framework to ensure that it contributes to sustainable and inclusive progress. We believe that the development of AI should be accompanied by in-depth reflection on the new risks it generates.

SIGNIFICANT ENVIRONMENTAL RISKS

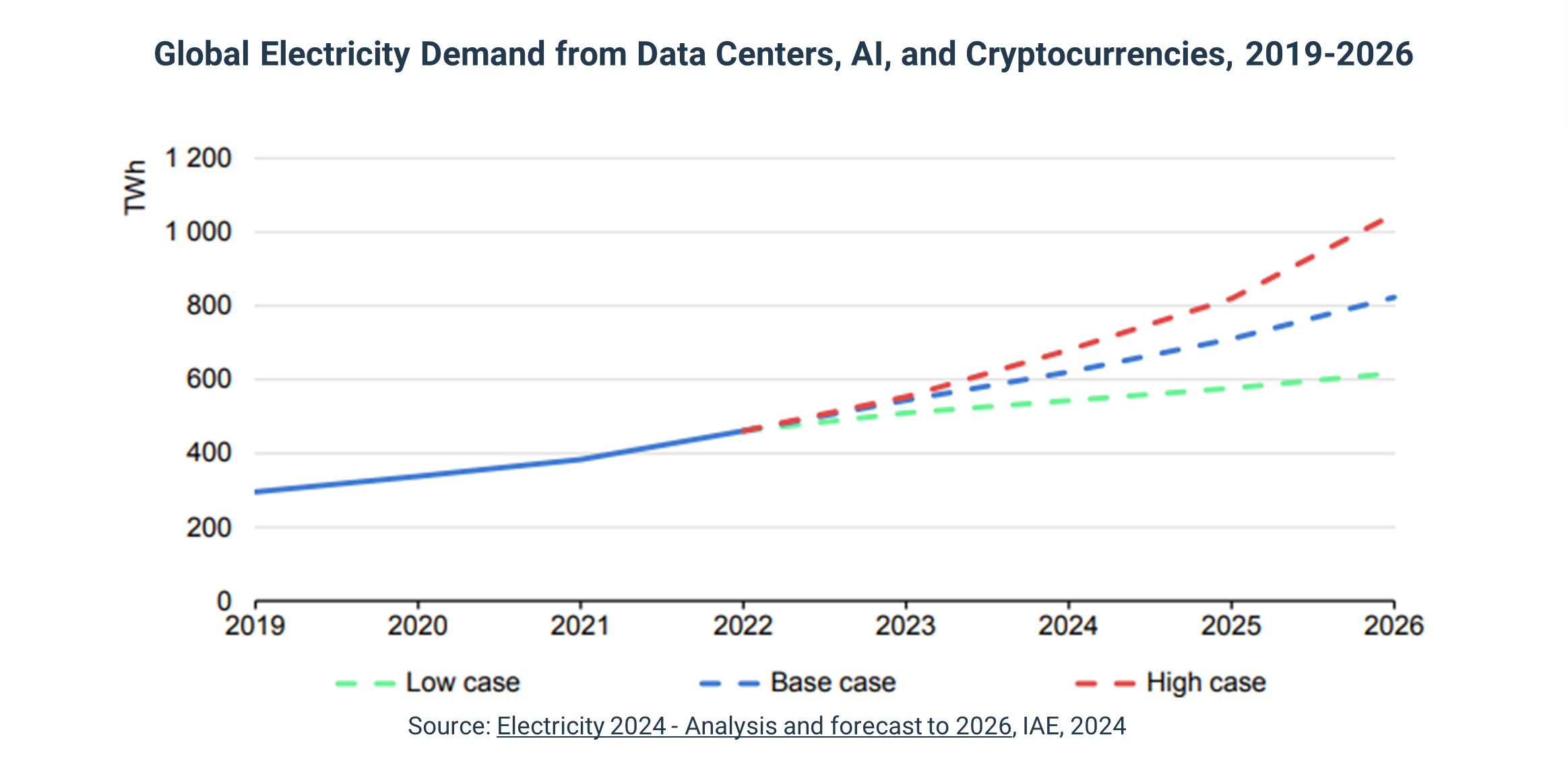

The rise of AI has a significant impact on the carbon footprint of information and communication technologies (ICT). Estimates of the share of the ICT sector in global greenhouse gas (GHG) emissions vary in the literature, ranging from 1.5% to 4%[3]. The energy consumption of data centers, which host and train AI models, is one of the main factors contributing to the constant increase observed. These infrastructures accounted for between 1% and 1.3% of global electricity demand in 2022, a share that could double by 2026 due to the rise of generative AI models[4]. However, on a global scale, data centers would represent only about 12% of the increase in electricity demand by 2030[5]. Furthermore, it is challenging to find reliable data due to a lack of transparency in the training and inference of AI models.

The pressure of data centers on electrical grids poses an increasing challenge, particularly in countries where demand is concentrated. In the United States, they already consume nearly 4% of national electricity, a figure that could reach 9% within a decade, necessitating the construction of 50 GW of new capacity[5]. In Ireland, their share reaches 21%, jeopardizing energy balances[5]. While each new generation of electronic chips required for AI computations becomes more energy-efficient, it is accompanied by increasingly complex models, whose size grows by 3.5 times per year[5]. In the face of this growing energy demand, renewable energies could cover about half of the additional electricity needs in the United States, through power purchase agreements (PPAs) between technology companies and electricity producers. For the remainder, technology players are heavily investing in nuclear energy: one-third of U.S. nuclear plants are reportedly already in discussions to sign PPAs. However, with a few exceptions, direct investments by tech players in nuclear energy remain limited due to uncertainties surrounding the scaling up of the new generation of nuclear power. Thus, in the short term, there is a resurgence in the use of shale gas, with delayed plant closures and investments in new capacities. It is therefore crucial to rethink the use of AI by favoring more frugal models, particularly smaller and specialized ones, in order to limit their impact while ensuring a balance between innovation and energy sustainability.

The environmental impact of AI is not limited to its electricity consumption. The manufacturing of semiconductors and electronic components necessary for digital infrastructures relies on critical minerals, the extraction of which causes significant damage to biodiversity. Additionally, data centers are particularly water-intensive for cooling their servers. It is estimated that by 2027, their water consumption could reach 6.6 billion cubic meters, which is nearly half of the annual consumption of the United Kingdom[6]. The pressure on water resources is even more concerning given that 32% of data centers in the United States are located in areas of high water stress[7].

SIGNIFICANT ETHICAL AND SOCIAL RISKS

Beyond environmental implications, challenges related to ethics and transparency are emerging with the increasing adoption of AI solutions. One of the major risks lies in algorithmic biases, which can lead to discrimination based on gender, origin, or socio-economic status.

AI also poses a challenge to the protection of personal data. The massive exploitation of sensitive information and the opacity of models make it difficult to control data usage. Concerns are emerging, particularly around the spread of misinformation and the use of deepfakes, which could undermine democratic processes and amplify social inequalities.

Furthermore, the rise of AI raises significant social risks. On one hand, the working conditions of those involved in training models, especially in emerging countries, raise human rights concerns. On the other hand, accelerated automation threatens jobs: 300 million positions could be eliminated or devalued in the coming years[8].

A robust governance framework is therefore essential to mitigate these ethical and social risks. Technology companies must enhance the transparency of their models by publishing reports that detail their methodologies and bias control mechanisms. They must also establish governance structures dedicated to AI ethics and ensure that their practices adhere to strict standards concerning privacy, data protection, and the mitigation of social risks.

Activate All Engagement Levers for Ethical and Transparent AI

ACTIVE SHAREHOLDER ENGAGEMENT FOR RESPONSIBLE INNOVATION

We believe that active dialogue with technology companies is essential for ensuring that innovation genuinely serves sustainability goals. One of the pillars of our engagement strategy focuses on reducing the carbon footprint of AI infrastructures. We have identified three priority areas: encouraging companies to uphold their commitments to green energy, promoting investment in electrical grids to support the growth of renewable energy, and advocating for the adoption of more efficient data centers that consume fewer natural resources.

First and foremost, in light of the energy consumption of data centers, we call on technology players to commit to massive procurement of green electricity. In addition to being decarbonized, renewable energies are often cheaper and faster to deploy than gas and nuclear power plants. The signing of power purchase agreements (PPAs) must ensure that their energy needs are met at all times throughout the year, without increasing pressure on electrical grids. Large-scale data centers, known as hyperscalers, must also actively participate in financing electrical infrastructures to achieve better integration of low-carbon energies and avoid a shift towards fossil fuel sources.

Furthermore, the siting and optimization of data centers need to be rethought to minimize their environmental impact. The construction of new infrastructures cannot be a blanket response to the rise of AI. It will become crucial to explore the modernization of existing infrastructures and buildings, prioritizing locations that reduce energy and water resource conflicts, while relying on stable networks and accessible renewable energy sources. Improving their energy efficiency and reducing their water consumption are also priorities: managing Power Usage Effectiveness (PUE) and Water Usage Effectiveness (WUE) must be central to the strategies of companies in this sector. More water-efficient cooling technologies, energy optimization software, and the use of lighter AI models can help address these challenges.

Overall, the goal is to promote a more frugal AI through lighter and more targeted approaches for accessing data and computing resources tailored to specific needs.

We support these transformations by encouraging technology companies to adopt more sustainable practices and by integrating these criteria into our investment decisions. We are convinced that the transition to responsible AI cannot occur without strong mobilization from investors, companies, and regulators to reconcile innovation and sustainability

A COLLECTIVE COMMITMENT TO ETHICS AND TRANSPARENCY

We are committed to actively contributing to initiatives that promote the development of this market in alignment with principles of responsibility and transparency. This commitment is based on two fundamental pillars. On one hand, we maintain a constant dialogue with technology companies and regulators to encourage their development while respecting fundamental rights and environmental imperatives. On the other hand, we are dedicated to demonstrating transparency regarding our own use of AI, integrating ethical principles and assessing its impact on our operations and processes.

A major pillar of Mirova's engagement strategy is the establishment of transparency and governance mechanisms to regulate the use of AI. Our approach is based on a combination of individual and collaborative initiatives. We engage in direct dialogue with companies in the AI value chain, encouraging them to adopt more responsible practices and to integrate transparency mechanisms within their governance. This dialogue has become increasingly important due to recent positions taken by certain companies in the sector that have relaxed their moderation or inclusion policies.

In 2024, we initiated discussions with major players such as Microsoft regarding AI ethics and its environmental impact. We are also participating in collective initiatives, notably through the Coalition for Collective Impact of the Global Benchmarking Alliance for Ethical AI, which aims to enhance transparency among technology companies concerning their use of AI and the integration of responsible principles into their development. Additionally, we recently joined the Coalition for Sustainable AI, which aims to positively contribute to the development and use of AI in support of the Sustainable Development Goals (SDGs), particularly in the areas of climate and environmental concerns.

As a co-sponsor of the “AI and Finance” working group within the international One Planet Sovereign Wealth Funds (OPSWF) network, which brings together asset managers and the largest sovereign wealth funds in the world, we contribute to defining principles and recommendations for integrating AI in alignment with ecological transition and sustainable finance objectives. This collaboration allows us to engage with key investment stakeholders on best practices for regulating the use of AI in finance and anticipating emerging risks.

Our participation in the Summit for Action on Artificial Intelligence on February 10 and 11, 2025, which gathers decision-makers, experts, companies, and investors committed to the regulation and strategic direction of AI, reflects our desire to provide a responsible investor perspective to shape an ambitious and sustainable framework in collaboration with all stakeholders.

ACTIVE SUPPORT FOR ACADEMIC RESEARCH

To accelerate our understanding of the profound transformations brought about by AI, supporting academic research initiatives is another important lever. In 2024, Mirova established the Mirova Research Center to support the emergence of new fields of research in service of sustainable finance.

We have structured the Mirova Research Center around three fundamental pillars: the impact of AI and technologies, the development of indicators for a just transition, and the analysis of investor additionality.

The goal is to promote research that harnesses AI for sustainable finance while enhancing the understanding of the emerging risks posed by new technologies for investors.

THE REGULATORY CHALLENGE AT THE HEART OF CONCERNS

The regulatory framework should play a crucial role in structuring these best practices. The European Union has positioned itself as a leader in this area with the adoption of the AI Act. This regulation aims to guarantee the fundamental rights of European citizens while encouraging innovation. It imposes enhanced obligations regarding risk management, transparency, and governance of AI models. The challenge will be to demonstrate agility in the face of rapid technological advancements.

We collaborate with decision-makers to evolve regulatory frameworks and strengthen the accountability of companies in the sector.

AI: A Strategic Challenge for Mirova

Aware of the disruptive potential of AI in our sector, we have established dedicated governance and an operational roadmap to fully leverage this technology at Mirova while managing associated risks. This approach will enable us to guide the transformation of our teams and optimize our capacity to serve the interests of our clients.

STRUCTURED GOVERNANCE

The creation of dedicated governance aims to centralize and ensure the coherence of initiatives, their prioritization, and coordination. It will unite teams around a common vision. This approach is complemented by inclusive discussions involving all employees, fostering the emergence of best practices from the field and the younger generations, who are particularly agile in adopting new uses of AI. Valuing this collective expertise and encouraging knowledge sharing are essential levers for successfully navigating this transition.

AN AMBITIOUS TRANSFORMATION PLAN

Our transformation plan is based on a targeted approach around three use cases, where AI is used to enhance expertise and increase analytical capacity through the deployment of these use cases in partnership with several startups:

- Automation of analyses conducted in investment committees for real asset activities to reallocate team time towards more qualitative analyses and broaden ESG investment targets.

- Automation of ESG research analyses to focus team efforts on shareholder engagement strategy.

- Automation of bidding processes to accelerate the handling of requests, better support our clients, and strengthen our value proposition.

MANAGING RISKS

The transition to automation tools requires enhanced support for employees in evolving their skills and responsibilities. We are working on the upcoming integration of an expert in 'AI and work' within our mission committee to anticipate, in particular, the human impacts of these technologies.

As a mission-driven company[9], exemplarity is a requirement: the standards applied to financed companies must also guide our internal choices and practices. We impose high ethical and environmental impact criteria in the selection of suppliers, particularly startups with which we collaborate on these issues.

Finally, data management is an absolute priority. For example, we favor sovereign clouds and, failing that, impose the highest cybersecurity standards on all our partners. Each project undergoes a thorough periodic assessment to ensure optimal risk management and complete data confidentiality.

Making AI a Force for Transformation Towards a Sustainable Future

Artificial intelligence represents a significant transformative force for our economy and society. Its rapid development opens immense prospects but also poses unprecedented challenges. AI can either become an accelerator of environmental and social crises or serve as a timely and innovative response to the transition towards a more resilient, inclusive economy aligned with sustainability imperatives. We have chosen to make it a driver of solutions rather than a factor exacerbating existing imbalances.

Our commitment is rooted in the belief that the digital revolution and ecological transition can converge. Beyond its role in the transition, AI is an accelerator of impact across all sectors of the economy, including asset management. We also have the responsibility to promote ethical and transparent AI. The rapid development of these technologies must be accompanied by rigorous governance.

As AI continues to evolve at an exponential pace, the risks it poses will intensify. It is imperative to anticipate these challenges today and adopt a proactive stance to regulate the evolution of this technology. Those who can integrate AI responsibly and strategically will be best positioned to benefit from it while limiting its negative externalities.

We encourage all our stakeholders to engage in this trajectory. At Mirova, we do not view AI as merely a technological evolution. We see it as a transformative tool whose impacts we must manage and direct towards a more sustainable model. We aim to shape a future where AI serves the common good and sustainability. This requires a shared responsibility among investors, companies, and regulators to ensure that this digital revolution is an opportunity rather than a threat to our planet and societies.

The mentioned securities are provided for illustration purposes only and should not be considered as a recommendation or solicitation to buy or sell. The data presented reflects the opinion of Mirova and the situation as of the date of this document and may change without notice.

[1] Source: “Landscape Assessment of AI for Climate and Nature”, Columbia University", 2024

[2] Source: Mirova

[3] Source: “Measuring the Emissions and Energy Footprint of the ICT Sector : Implications for Climate Action”, World Bank Group, 2024

[4] Source:“Electricity 2024 - Analysis and forecast to 2026”, IAE, 2024

[5] Source: “The Impact of Data Centers on Energy Demand and Market Prices”, Ike Brannon, 2024

[6] Source: “Making AI Less “Thirsty: Uncovering and Addressing the Secret Water Footprint of AI Models”, Cornell University, 2023.

[7] Source: “25 Countries, Housing One-Quarter of the Population, Face Extremely High Water Stress”, World Resources Institute, 2023

[8] Source: “The Potentially Large Effects of Artificial Intelligence on Economic Growth”, Goldman Sachs, 2023

[9] Introduced in France in 2018 under the Pacte Law, a ‘société à mission’ company must define its "raison d'être" and one or more social, societal or environmental objectives beyond profit. The purpose, and objectives aligned with this purpose, must be set out in its Articles of Association. The Articles specify the means by which the execution of the Mission will be monitored by a Mission Committee (a corporate body distinct from the board of directors which is responsible for monitoring the implementation of the mission with at least one employee.) An independent third party then verifies the execution of the Mission, via a written opinion which is annexed to the report of the Mission Committee to shareholders and made available on the website of the company for a period of five years

News

Discover the 2024 Impact Report for Mirova Global Green Bond Fund.

Investing Insights from the Sustainable Equities Team

Mirova, Robeco, Edmond de Rothschild AM, I Care by Bearing Point and Quantis, a BCG company are proud to announce the official launch of a groundbreaking initiative: the Avoided Emissions Platform. This innovative global platform is dedicated to harmonizing the evaluation of climate solutions' impact by employing a transparent methodology for calculating avoided emissions — an essential metric for advancing the transition to a sustainable economy. AEP is supported by 12 asset managers and owners, representing more than USD 4 trillion of assets under management, as well as one international Corporate Investing Bank, six recognized data providers, 13 leading corporates and an independent scientific committee.