Trending Forward: AI across the value chain

Investing Insights from the Sustainable Equities Team

AI across the value chain: transforming industries and driving growth

In brief

- Generative AI is quickly transforming industries and driving a structural shift in the economy creating new opportunities for businesses to enhance productivity.

- We believe the market underestimates the long-term potential of generative AI and, as investors, it is important to have a deep understanding of the drivers of this opportunity across the value chain.

Technology

Artificial Intelligence

We invest in companies with meaningful exposure to economic tailwinds from longterm transitions that are affecting the global economy: demographics, environmental, technological and governance. The technology transition includes artificial intelligence, digitalization of the economy, and increasing connectivity and automation which are expected to transform industries, improve efficiency, and create new opportunities.

Artificial Intelligence (AI) is transforming our economy and reshaping the way we do business, and it is happening quickly. Traditional AI systems use pre-defined rules to perform specific tasks like pattern recognition while generative AI is more specialized and uses natural language processing to create new content like text, images, and video. While AI has been around for decades, generative AI experienced a surge in adoption and innovation in 2023, and this momentum continues with new applications emerging at an astonishing rate.

As we move towards a more interconnected world where self-driving cars and data-driven systems will become commonplace, the demand for powerful GPUs (graphics processing unit)—such as those produced by Nvidia—will only intensify. The development and expansion of generative AI impacts various industries that are showing early opportunities for strong performance, particularly in energy, cooling solutions, and IT consulting. These industries are crucial for supporting the infrastructure necessary for generative AI's growth and for companies leveraging AI to enhance productivity.

As the technology develops, its end-user applications will spread across industries, driving efficiencies, and creating new business opportunities. Companies that embrace and leverage generative AI technologies will benefit from this technological transformation.

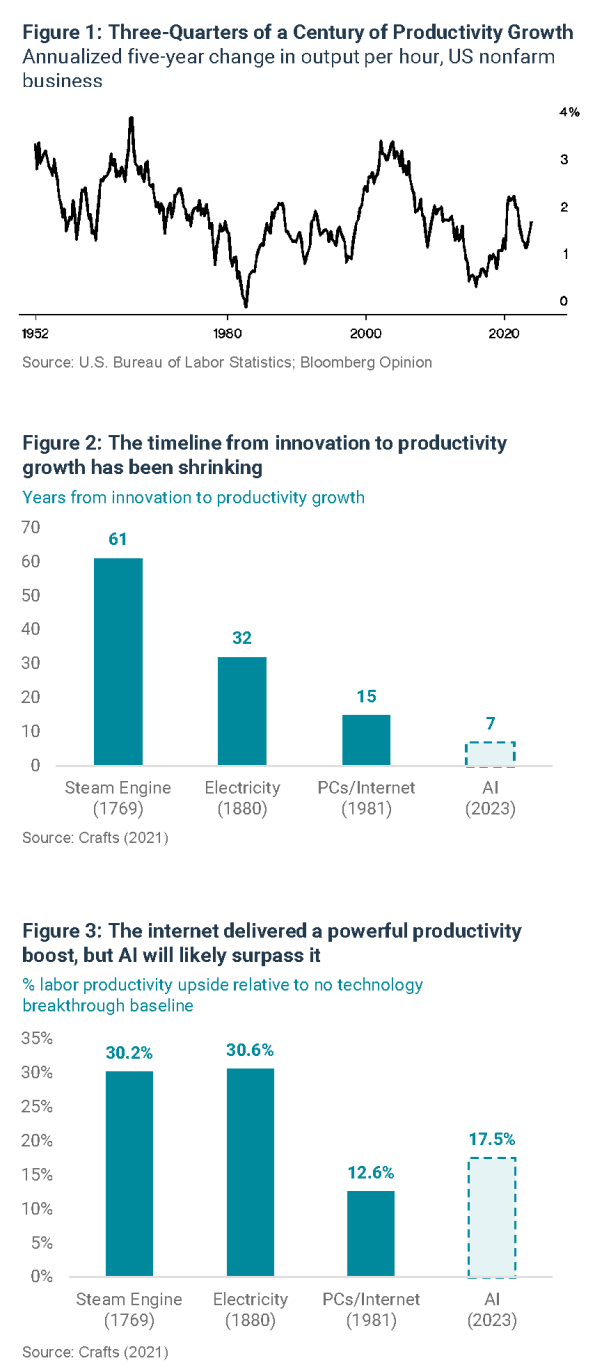

Historically, technology adoption has taken years, but we believe generative AI adoption will happen much quicker (Figure 1 & 2). The impending AI productivity boom is expected to result from the significant efficiency and productivity gains that companies and industries will achieve by implementing AI technologies across their operations. We expect the productivity increase to surpass that of the internet and deliver more economic value (Figure 3).

AI technologies could contribute up to $15.7 trillion to the global economy by 2030.1

While AI will automate repetitive and routine tasks leading to the displacement of some jobs, it will also create new job opportunities including reskilling and retraining the workforce in AI-related skills. This will create new growth opportunities for companies and investors.

60% of jobs in 2018 in the United States did not exist in the 1940s.2

We are looking across the AI value chain, from the companies that enable the development, deployment, and utilization of generative AI to those that benefit from increased efficiency using AI technologies. We have seen the early winners in the generative AI market, but we believe the market underestimates the long-term potential. As investors, it is important to have a deep understanding of the drivers of this opportunity and be selective in choosing companies to invest in.

One of the main challenges of generative AI is the timing of the return on investment. Many companies are spending capex dollars and building the infrastructure needed for data centers and cloud integrations to capture market share in what is expected to be a decade long growth driver. For this reason, we believe it is important to invest in companies across the value chain including the enablers selling infrastructure such as semiconductors and hardware, the IT services firms that are empowering this transition, and the software companies that will benefit in the medium term.

AI Enablers

INFRASTRUCTURE: GPUs (graphics processing units) are at the core of AI infrastructure needs, and innovations in chip design and manufacturing are essential to the scalability of AI technology. GPUs allow for the processing of thousands of tasks simultaneously, which makes them well suited for AI workloads.

Nvidia is the primary supplier for high-end GPUs used for generative AI across the globe. The company controls more than 90% market share in data-center GPUs and more than 80% market share in AI processors. 3

CLOUD PLATFORMS: Cloud platforms such as Azure, AWS, and GCP enable businesses to rent hardware and software for AI as a service, allowing them to store data and utilize AI tools without investing in their own GPUs, infrastructure, and data centers.

Microsoft’s Azure cloud platform was launched in 2010, and the shift toward AI services occurred in 2023, leading to strong cloud growth contributing 12 percentage points to Azure growth in the third quarter of 2024. They are seeing massive scale due to having a full Cloud/ AI/Application stack and seeing considerable capex leverage, expecting to spend over $60bn (excluding leases) in capex for fiscal year 2025. 4

IT CONSULTING: IT consultants are implementing generative AI solutions and modernizing infrastructure for clients to utilize and benefit from generative AI products. Consulting firms are training thousands of employees and committing billions of dollars toward AI to effectively support clients adopting AI technology with strategy development and implementation.

Accenture has been at the center of structural tech transformations for many years. In 2023 the company announced an investment of $3bn over 3 years to train 40,000 new AI focused employees. They have been the leader of cloud, data, and digital transformation and are now aiming to be the leader in generative AI implementation for their clients. 5

AI Beneficiaries

SOFTWARE: Software companies are creating generative AI end user applications for business and consumer use cases. Front-office use cases will see the quickest uptake as they can save money and increase productivity in day-to-day operations, resulting in higher sales and more efficiencies.

Salesforce is creating an Agentforce product that uses natural language, LLMs (large language models), and generative AI to understand the full context of customer messages and then determine and execute appropriate actions based on your company’s CRM (customer relationship management) data guidelines on its own, without the need of a human agent.

ENERGY & UTILITIES: Power generation for data centers will increase to 11-12% of total US power demand in 2030 up from 3-4% in 20236 at a CAGR 22% from 2023 to 20307 . By 2030, about 70% of data center demand will be from AI8 . To meet these power demands, hyperscalers are looking for new locations, and new supply from nuclear, renewable, and traditional power producers as well as batteries. Their biggest priority is speed to market.

NextEra Energy is an electric power and energy infrastructure company in North America that sells traditional as well as clean energy. They have the capabilities to develop the fast-to-deploy low-cost generation at scale that will be needed to support the increased demand.

DATA CENTERS: While GPUs are the most top-of mind component when creating AI data centers, there is more infrastructure needed including servers, networking components, storage, high-bandwidth memory, electrical, thermal, HVAC (heating, ventilation, and air conditioning), and security and fire systems.

Johnson Controls International manufactures, installs, and services building solutions across a variety of end markets with a vertical-specific offering for data centers. While thermal equipment is a core part of the offering, Johnson Controls also addresses key requirements including building security and fire safety.

Promoting Responsible AI

While the opportunities of AI are plentiful, as investors, we also consider the risks associated with AI adoption, including the potential social and environmental risks. AI raises ethical concerns such as the potential for disinformation, exacerbating biases, threats to privacy or intellectual property rights infringement. As such, we closely monitor and promote the implementation of ethical AI guidelines and governance structures through a dedicated targeted engagement roadmap to address these risks with the companies we invest in.

While AI has the potential to offer solutions for the fight against climate change and other environmental challenges in the future, the environmental impact of AI is significant. The global demand for energy and raw materials associated with AI technologies is rising alongside increasing demand for AI applications. For this reason, we are looking into the resource use and sustainability targets of data centers and companies involved in the AI value chain. We advocate for the development of AI that prioritizes renewable and clean energy sources and energy-efficient technologies to minimize carbon emissions.

1 PWC. “PwC’s Global Artificial Intelligence Study: Exploiting the AI Revolution.”

2 “The Labor Market Impacts Of Technological Change: From Unbridled Enthusiasm To Qualified Optimism To Vast Uncertainty.” Autor et al. (2022)

3 Forbes. “Nvidia Vs. AMD Vs. Intel: Which AI Stock Is Best As Competition Heats Up?” November 2024.

4 Source: Mirova Research.

5 Source: Mirova Research.

6 McKinsey & Company. “How data centers and the energy sector can sate AI’s hunger for power.” September 2024.

7 NextEra Energy quarterly conference call. Third quarter 2024.

8 McKinsey & Company. “AI power: Expanding data center capacity to meet growing demand.” October 2024.

The securities mentioned above are shown for illustrative purpose only and should not be considered as a recommendation or a solicitation to buy or sell. The information provided reflects MIROVA’s opinion as of the date of this document and is subject to change without notice. The reported data reflect the situation as of the date of this document and are subject to change without notice.

NEWS

Investing Insights from the Sustainable Equities Team

The Brief by the Energy Transition Infrastructure team