Trending Forward: Rethinking Globalization

Investing Insights from the Sustainable Equities Team

IN BRIEF

• Geopolitics and global events have influenced the ways in which companies are organized to serve their customers.

• Changes in globalization and power dynamics impact companies across industry groups, with some business models at risk of disruption and others benefiting from the reorganization of supply chains, increased focus on security and an emphasis on local business.

• These trends will provide long-term opportunities for investors but will require selectivity.

RETHINKING GLOBALIZATION

Governance

Rethinking Globalization

As part of our investment process, we conduct a thematic analysis to identify and assess the long-term trends that are shaping our world and global economies across four major transitions: Demographics, Technology, Environment and Governance. At a high level, we define the Governance transition as the collection of long-term trends impacting how global economies are organized, including shifting geopolitics, rethinking of globalization and global supply chain dynamics. As these trends have intensified over the last three to five years, we have reassessed the implications for various business models and market opportunities going forward.

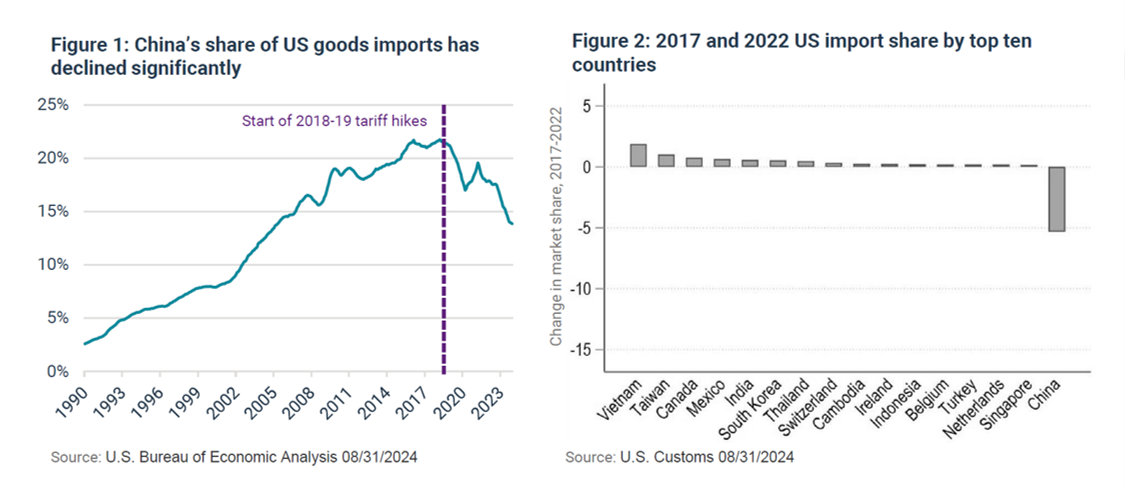

After decades of globalization, countries and companies are now rethinking how supply chains are organized. This shift is driven by a changing geopolitical landscape, the emergence of new global powers and recent global events which have revealed global supply chain weaknesses and risks. Global supply chain diversification has become more apparent, especially since 2018 when major US tariffs on Chinese goods were implemented (see Figure 1), with trade data indicating de-coupling and de-risking of supply chains. The share of US imports from other countries has increased from 2017 to 2022, while the share from China has declined over the same period (see Figure 2). While this has raised questions over whether goods are being rerouted from China through other countries, research indicates that there are multiple factors that have likely contributed to changes in trade patterns1. Despite the continued strong reliance on China for trade, supply chains are diversifying, resulting in positive economic growth for other countries.

The rethinking of globalization and shifting power dynamics will have long-term implications across industries. These trends are likely to create winners and losers within certain industries, impacting competitive dynamics and creating risks for certain business models. Focusing on where we may identify investable opportunities, we look across industries seeking out companies we believe may be poised to benefit from these trends, including those positively exposed to or enabling the reorganization of supply chains, increased emphasis on security or local businesses.

Industry implications

SUPPLY CHAINS

Geopolitics, including national alliances, and global events such as the COVID-19 pandemic have led companies to reassess how and where they operate and organize supply chains. There are several drivers for wanting to reorganize supply chains, including reducing redundancies, addressing the impacts of trade agreements and tariffs, and improving the reliability of supply chains to mitigate vulnerabilities such as those exposed during the COVID-19 pandemic.

Geopolitical risk can be reduced through “friendshoring” (the reorganizing of supply chains to countries that are political and economic allies especially for the supply of critical materials) while costs can be reduced through measures including “nearshoring” (the shifting of supply chains to nearby countries).

The industries that will help enable or benefit from the reorganization of supply chains include:

• Capital goods: enable the buildout of additional factories and facilities

• Transportation: enables the movement of goods

• Semiconductor equipment: enables redundancy and expansion in a geopolitically sensitive end market

• Utilities: enable the power supply for new infrastructure

• Supply chain software and contract manufacturing services: enable the monitoring of infrastructure and outsourced production

• Nearly all industries benefit if supply chains are more time efficient and cost effective

DID YOU KNOW: About one in four businesses (28%) that currently manufacture in Asia report planning to move out of the region in the next five years2.

CANADIAN PACIFIC KANSAS CITY: The rethinking of global supply chains has led to an acceleration of re-, near- and friend-shoring trends. With Mexico overtaking China’s share of total US imports in 2023, CPKC is a key beneficiary as the only railway connecting key industrial areas in Mexico to the US/Canada.

SECURITY

Shifting power dynamics have led to an emphasis on security and independence, with nations and companies increasingly focused on protecting and securing, for example, information systems and data, energy supplies, critical materials and healthcare supplies.

DID YOU KNOW: 1 in every 10 organizations worldwide were hit by attempted Ransomware attacks in 2023, up 33% from previous year3.

PALO ALTO NETWORKS: Provider of enterprise cyber security solutions, which are increasingly important given the rising rate of global cybersecurity attacks, in part driven by shifting power dynamics and geopolitical tensions.

Examples of industries that help enable national and corporate security priorities:

• Security software: enables protection from cyber attacks

• Energy (including renewables): enables independence of supply

• Healthcare: enables independence for supply of critical devices and pharmaceuticals

• Global Banks: facilitate capital flow and lending restrictions in the name of national security

• Mining: produces independent supply of critical minerals materials for purposes including renewable energy

RENEWABLE ENERGY

Geopolitical tensions reinforce the strategic importance of energy security and independence, requiring renewables to play a larger role. The public policies articulated on both sides of the Atlantic (US Inflation Reduction Act & European Green Deal) are especially focused on increasing local production capabilities in low-carbon energy and related technologies, thus promoting investment in the sector and energy sovereignty.

Examples of renewable energy companies positioned to enable the power supply for new infrastructure and support energy security in different regions include Vestas Wind Systems, Enphase Energy, NextEra Energy and Iberdrola.

LOCAL BUSINESSES

Companies that enable local, often small- and mid-sized businesses, may benefit as countries increasingly emphasize local suppliers, including software and professional services that enable functions including sales/ecommerce, payroll, HR and finance, as well as banks that enable capital and business formation via regional and local lending.

DID YOU KNOW: Small and midsize businesses represent a massive segment of the US economy: 44% of GDP (gross domestic product) and nearly half of the American workforce4.

SHOPIFY: A cloud-based commerce platform enables local and small business by addressing some of the greatest challenges that small- and medium-sized business face. Shopify provides essential internet infrastructure to start, grow, market, and manage a retail business. It creates an omni-channel experience that enables merchants to showcase their own brand.

The information provided reflects MIROVA’s opinion as of the date of this document and is subject to change without notice. The reported data reflect the situation as of the date of this document and are subject to change without notice.

1Federal Reserve. “As the U.S. is Derisking from China, Other Foreign U.S. Suppliers Are Relying More on Chinese Imports.” August 2024

CFA® & Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

The securities mentioned above are shown for illustrative purpose only and should not be considered as a recommendation or a solicitation to buy or sell. The information provided reflects MIROVA’s opinion as of the date of this document and is subject to change without notice. The reported data reflect the situation as of the date of this document and are subject to change without notice.

2US Chamber of Commerce. “Supply Chain Strategies and Nearshoring Opportunities in the Americas.” May 2023

3Checkpoint. “Check Point Research: 2023 – The year of Mega Ransomware attacks with unprecedented impact on global organizations”

4McKinsey & Company. “Winning the SMB tech market in a challenging economy.” February 2023.

News

Discover the 2024 Impact Report for Mirova Global Green Bond Fund.

Investing Insights from the Sustainable Equities Team

Mirova, Robeco, Edmond de Rothschild AM, I Care by Bearing Point and Quantis, a BCG company are proud to announce the official launch of a groundbreaking initiative: the Avoided Emissions Platform. This innovative global platform is dedicated to harmonizing the evaluation of climate solutions' impact by employing a transparent methodology for calculating avoided emissions — an essential metric for advancing the transition to a sustainable economy. AEP is supported by 12 asset managers and owners, representing more than USD 4 trillion of assets under management, as well as one international Corporate Investing Bank, six recognized data providers, 13 leading corporates and an independent scientific committee.