Ideas

Meet Gen Z, which are individuals born between 1996 and 2016, and accounting for a third of the global total population1. They never knew a world without internet and are more likely to be connected much of the time. We also believe they are more socially and environmentally aware and not afraid to voice their opinion. They are entering the workforce and are inclined to choose companies that are more aware of sustainability. We think that other generations will have to adapt to them, not the other way around, and they better do it fast and sustainably, as we feel the Gen Z disruption is in motion.

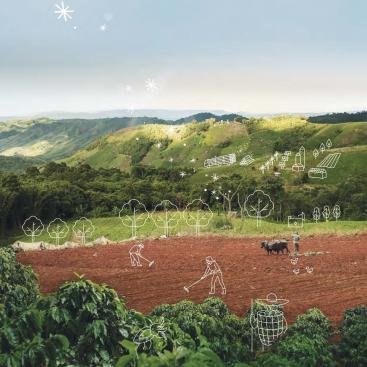

Discover the Althelia Climate fund impact report for 2020.

Discover the 2020 Althelia Sustainable Ocean Fund Impact Report.

Discover the first impact report for the LDN Fund.

The gradual reduction of public support measures is ushering renewable energies into a new era: that of autonomy on electricity trading markets. The way in which the associated risks are managed (volatility, cannibalisation effects, modification of the supply/demand equilibrium, buyer consideration, etc.) therefore becomes a fundamental issue in the project’s business plan and consequently for all stakeholders. In this article, Mirova offers a look at merchant risk, how it can be analysed, the strategies to guard against it and the opportunities that can be seized.

Today’s world is changing, led by long term transitions: demographic, technological, environmental and related to corporate governance. In this interview, Amber Fairbanks and Manon Salomez give their view on the impact of Covid-19 on corporate governance, and share Mirova’s vision, putting the emphasis on the creation of shared value over the long term.

As Joe Biden prepared for the inauguration, he tweeted "It’s a new day in America". And what a day! Hours after taking the presidential oath, Biden announced that the United-States would rejoin the Paris Climate Agreement as promised during his electoral campaign (in essence the starting of a new climate era in the U.S. and the global race to a net zero economy).