Understand

The challenge is to know not only how changes in our environment impact our business, but also what impact our business has on changes in our environment. This is true for the companies and projects we invest in, true for us, and true for our investors.

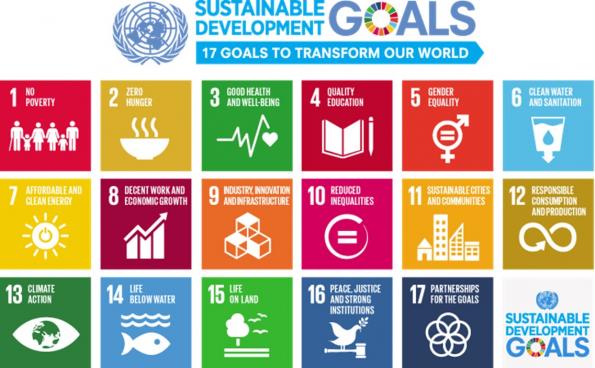

A research philosophy focused on the Sustainable Development Goals

Seeking to act as a ‘responsible investor’ implies an understanding of the economic sphere, and more generally of the society and environment in which it is embedded. This approach cannot be limited to a study of the short- to medium-term profitability of each individual asset.

This approach requires an understanding of interactions among all the various participants: public and private actors, small, medium and large companies, developed and developing economies, in order to ensure that the growth of each is compatible with the equilibrium of the system as a whole. It must also adopt a long-term scale, ensuring that today's choices will not have negative consequences for future generations.

To understand these interactions, our fundamentals-driven management draws on a responsible investment research team, strengthened by the complementary expertise of its members and united around a common philosophy, aligned with the Sustainable Development Goals (SDGs) defined by the United Nations.

"Our methodology rigorously evaluates environmental and social impacts, based on comprehensive sector analyses and clearly defined minimum standards. This methodology guides our investment processes and promotes sustainable development."

These 17 Goals lay a framework for positive action on key environmental and social challenges. For companies and investors, this means not only socially responsible conduct, but also an ability to offer solutions via innovative products, services and technologies.

Our approach to analysis seeks above all to identify those companies and projects able to provide solutions that will help meet the SDGs.

Source: United Nations, 2015

Minimum standards

Our Minimum Standards document summarizes our positions on major issues deemed controversial or that have negative impact on the achievement of sustainable development goals. Our Minimum Standards are split into two categories: a first section of this document outlines the standards that can be automated through a quantitative approach of pre-set indicators such as revenue (“Exclusion Categories”); the second section addresses our qualitative position on topics and sectors that still require further due diligence, typically carried out on a case-by-case basis (“Other Minimum Standards”).

Our sector vision

Energy

Mobility

Building

Resources

Consumer

Health

Technologies

Finance

In 2025, Mirova once again achieved the highest possible score (★★★★★)[1] across all modules assessed by the Principles for Responsible Investment (PRI). This consistency reaffirms the strength and maturity of its responsible investment approach, while highlighting significant progress in governance, transparency, and ESG risk management.

Ten years after the Paris Agreement, COP30[1] in Belém unfolded against a backdrop of shifting global dynamics, where climate issues are increasingly intertwined with strategic, industrial, and sovereignty considerations. While the final text does not resolve all uncertainties, it confirms a clear trajectory: climate finance is entering a phase of maturity, one that demands greater credibility, transparency, and measurable outcomes. For Mirova, this 30th edition highlighted both the growing influence of actors from the Global South and the emergence of more robust financial tools capable of mobilizing private capital at the scale required.