Mirovα, Creating Sustainable Value - April 2024

Monthly market review and outlook

After the bullish rally, which drivers will markets look to?

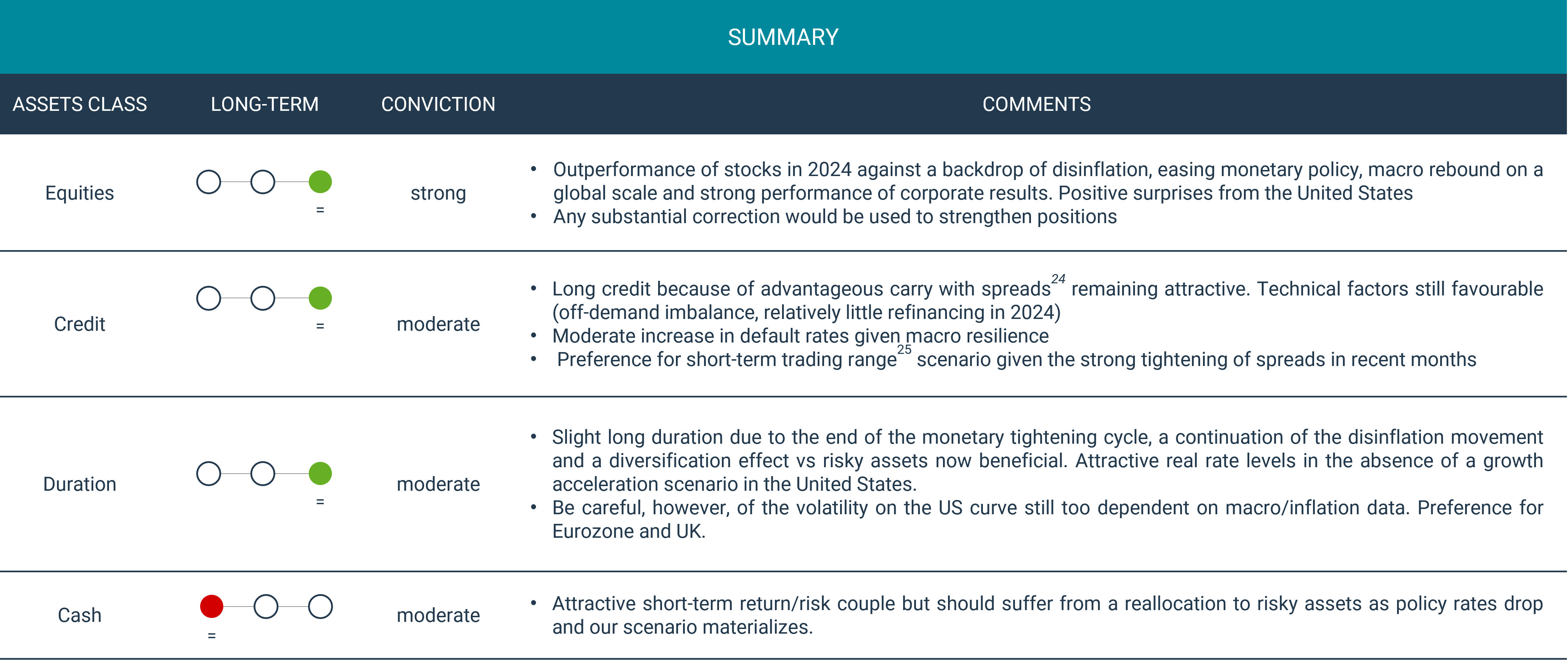

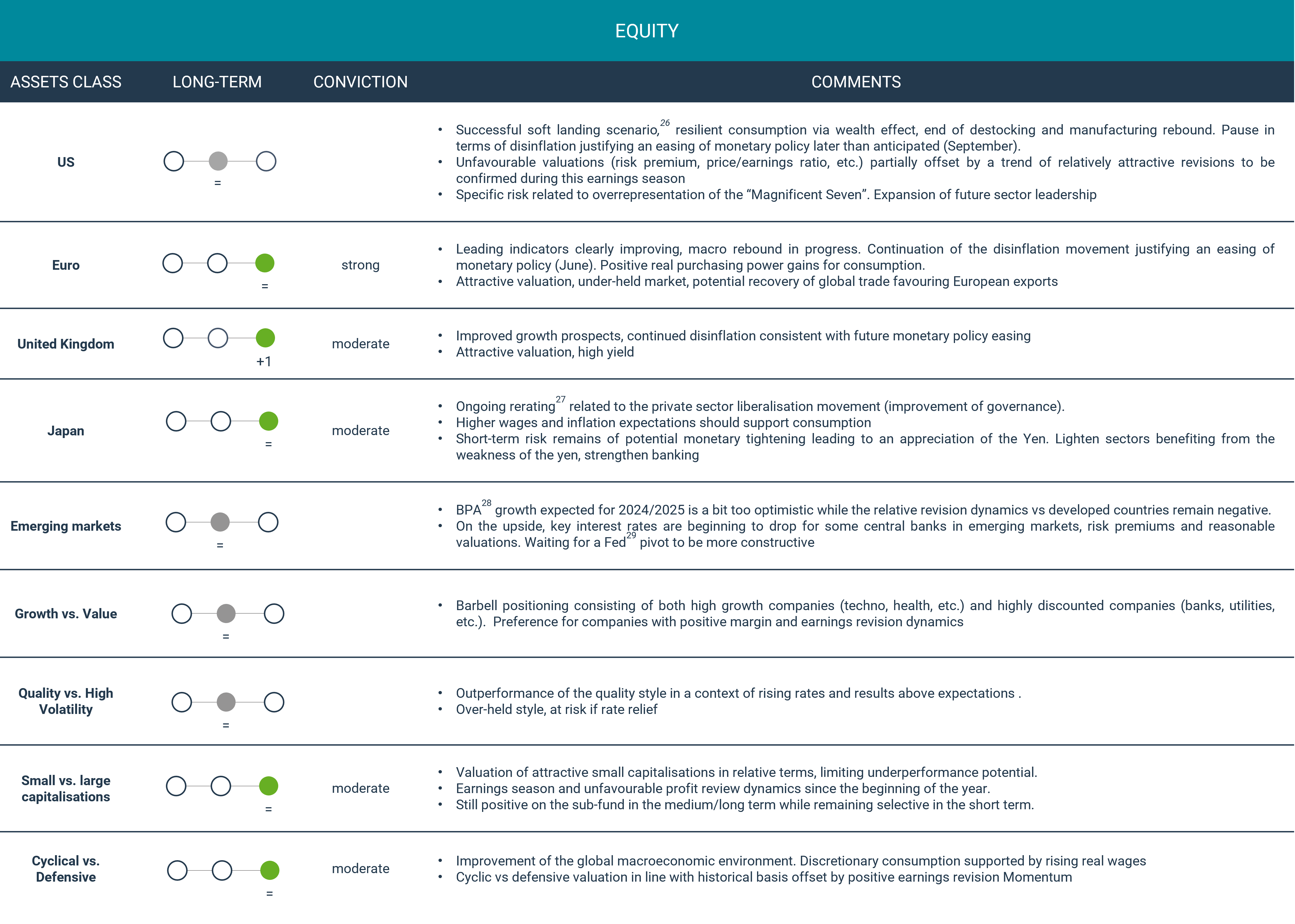

The end of the first quarter confirms a strong performance by risky assets1, in line with the rally observed since November 2023. Several equity indices have now peaked, such as the S&P 5002, up more than 10%3 over the first three months of the year, resulting in weekly gains for 16 out of 18 cases, a first since 1971. The Nikkei4 also rose more than 20%3 in Q1, surpassing its previous record from 1989. Investors are now ruling out the risk of a global recession as growth delivered surprising strength in the United States and is beginning to recover elsewhere. Also fuelling the early-year rally has been the craze for AI,5 especially its flagship company Nvidia (+82%3 in Q1).

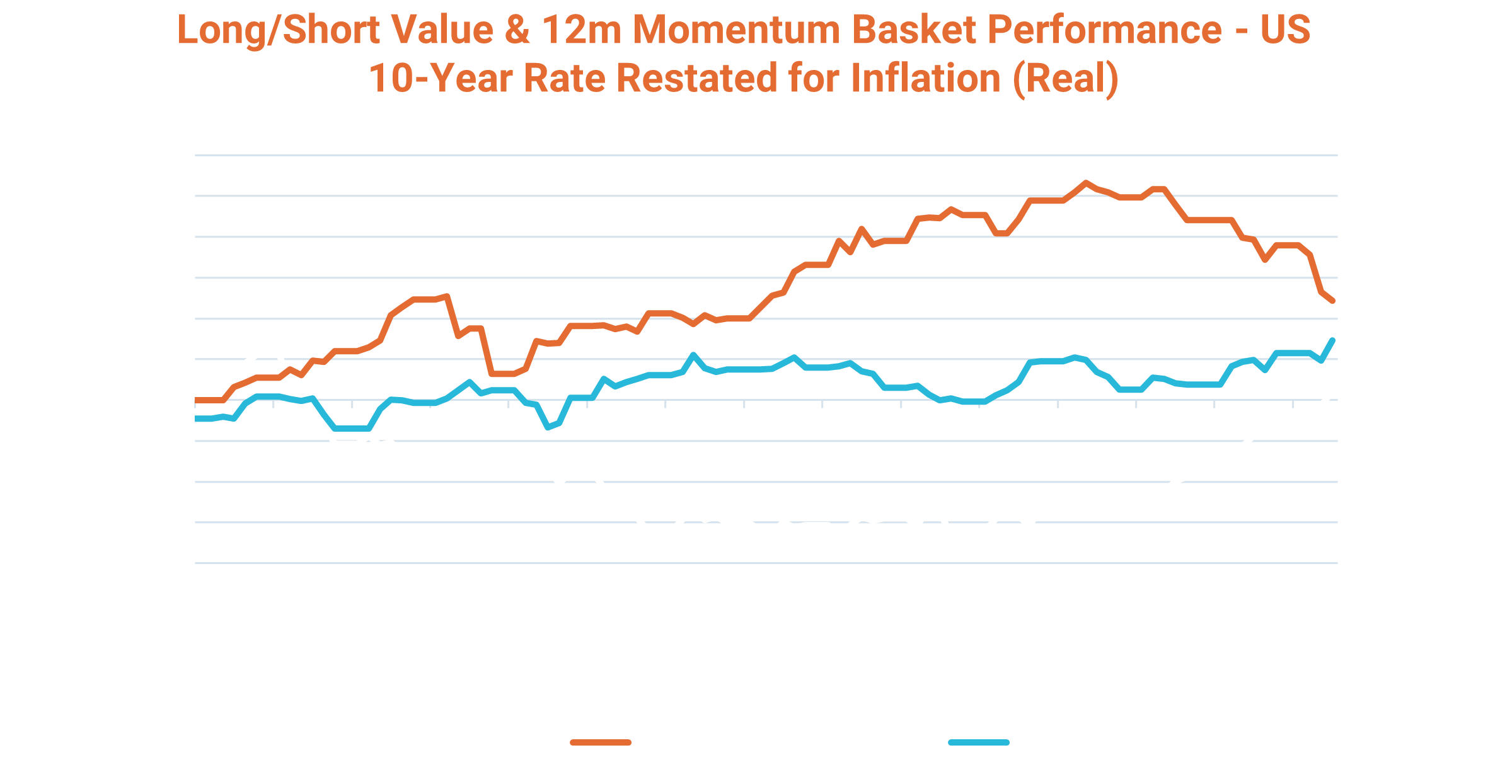

It is worth noting that in March, allocations began shifting towards European shares and heavily discounted and under-owned value-style sub-funds.6 Profit-taking on mega caps growth is beginning to emerge. This is unsurprising in light of a global growth scenario above expectations which could spread to other parts of the economy. The market is looking for new leadership to feed the rise or maintain current levels. However, everyone should bear in mind that markets remain dependent on US technology mega caps, which carry significant weight in US and global indices: close attention must be paid to potential repercussions should their results prove disappointing.

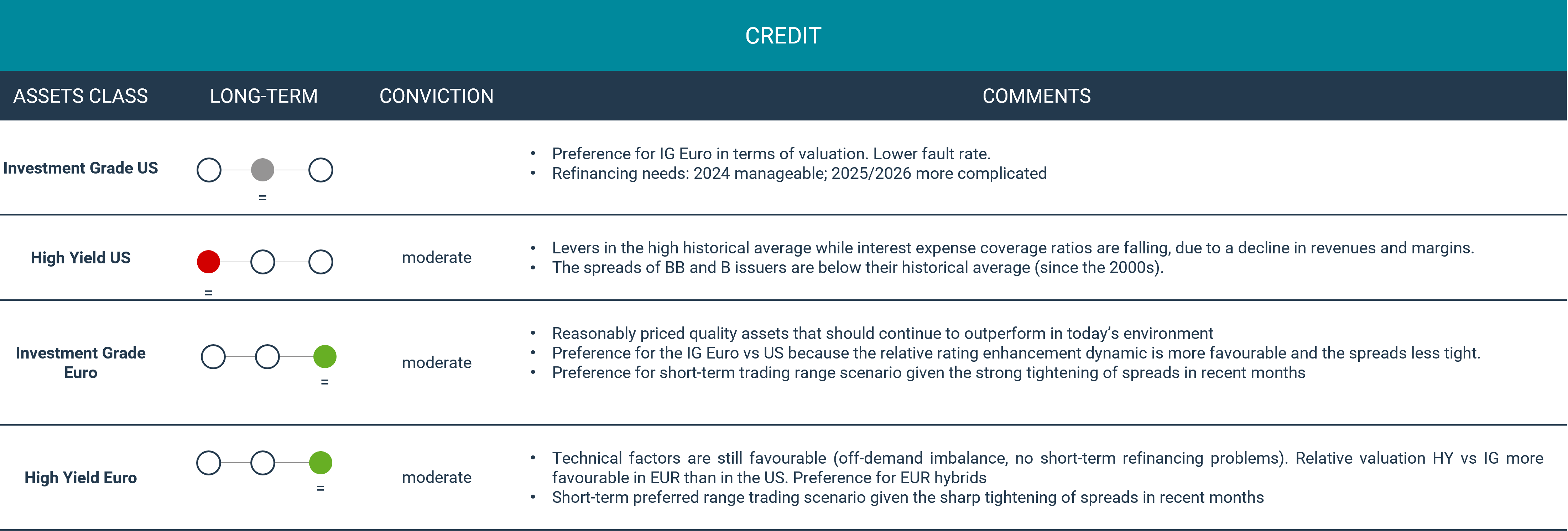

In the credit market, spreads7 have tightened since the beginning of the year (25-30 bp3 on average for Investment Grade and High Yield Euro at end March) with a slight inflection nevertheless in recent weeks. We believe there is still headroom to capitalise on, because companies have strong balance sheet structures, with ample liquidity that will probably encourage significant numbers of the most leveraged companies to pay down their debt rather than return all cash to their shareholders. A slightly less buoyant catalyst comes from the fact that, after months of drying up, the primary high yield market8 saw issuers return in March.

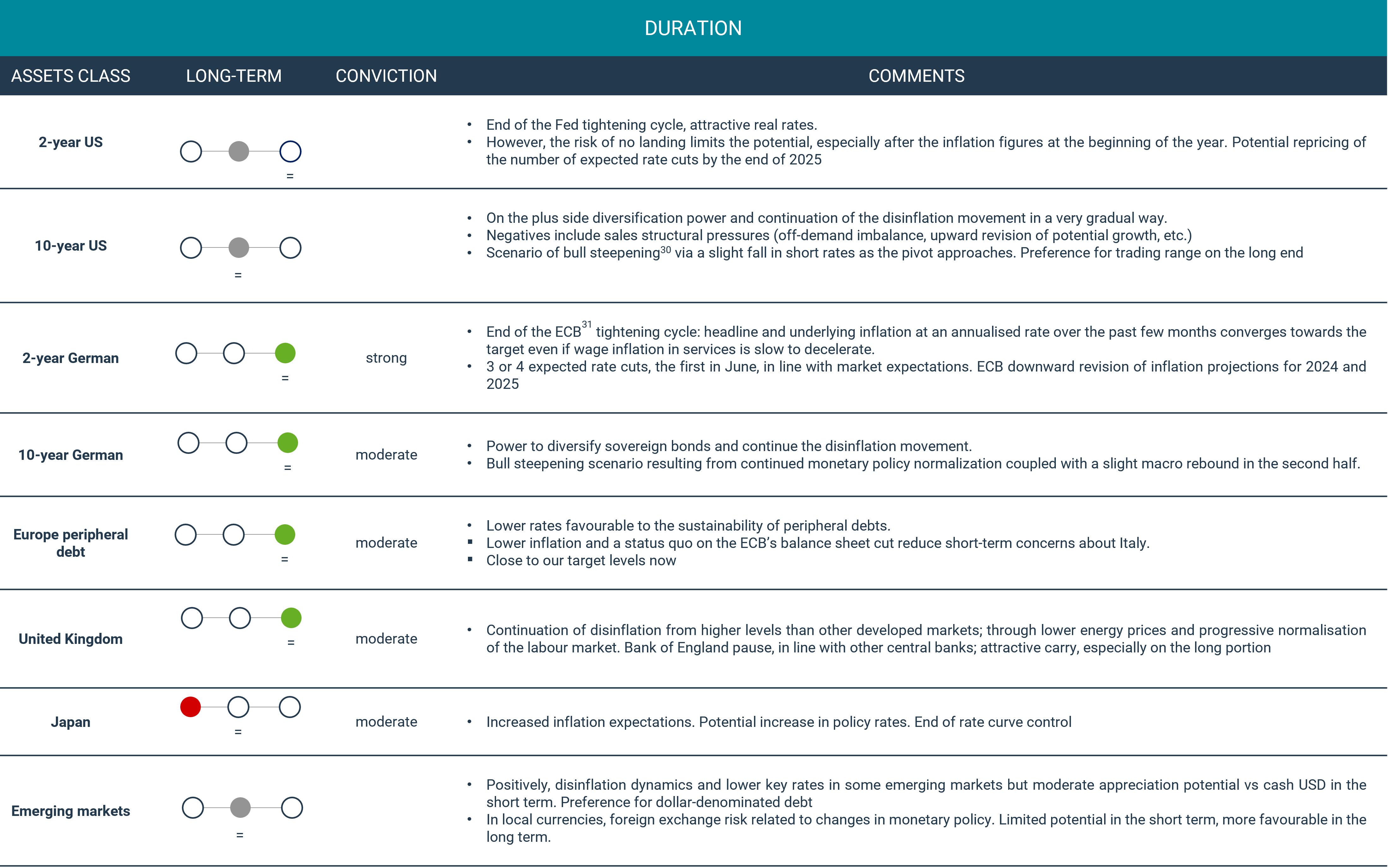

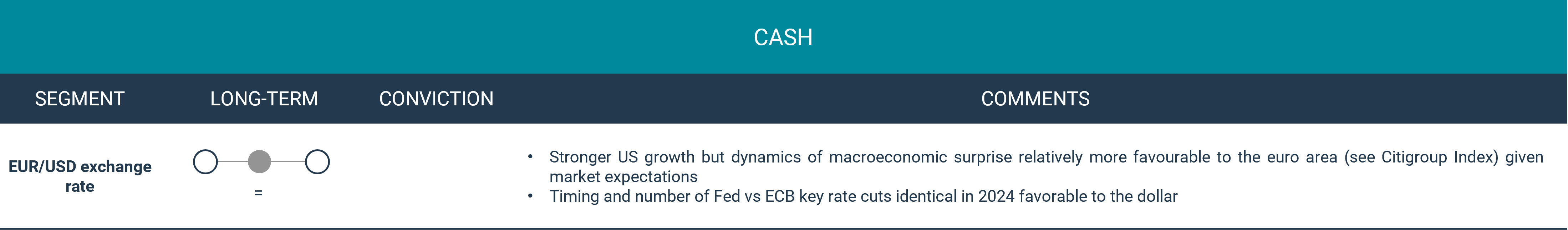

This said, the quarter proved less promising for holders of sovereign bonds, with losses of -0.8%2 for the US aggregate indices and -0.3%3 for European ones. Why? Increasing growth and inflation expectations in the United States, as well as an almost uninterrupted rise in oil prices over the period. Among other factors, this is partially attributable to geopolitical context: Brent9 soared +14%,3 WTI10 +16%.3 It is true that US inflation figures slightly exceeded expectations at the beginning of the year, with a core11 CPI up 0.4%3 in January and February, compared to 0.3%3 expected, leading to a sharp increase in US inflation swaps at two years: from +37 basis points to 2.42%3 in the quarter. Meanwhile, US growth is clocking in above potential (2.5%3 of GDP now12 according to the Atlanta Fed). US 2- and 10-year rates ended the quarter up +37bp and +32bp respectively.3 At the beginning of the year, investors expected the Fed to lower its rates six times in 2024, starting as early as March. They are now counting on two to three cuts, but not until June or even September. This bolstered the US dollar, the G10’s most successful currency for the first quarter, which gained more than 3%.3

Chart of the month

Source: Bloomberg

Market review & Outlook

The Goldilocks scenario continues, but...

Goldlilocks caution: higher hurdles ahead!

Employment in the United States: talk about strength!

In the United States, the latest employment market figures are impressive, with 303,00013 new jobs created in March, after 270,000 in February and just 200,00013 expected. This is the highest level in ten months. The unemployment rate fell slightly to 3.8%13, compared to 3.9%13 in February, while the number of hours worked rose. We note an increase in hiring to more cyclical sectors such as construction and retail, which fall outside the public sector, proof of a robust private sector. The Household Survey bounced back strongly, contradicting the thesis that business survey data (Payroll survey) overestimated market dynamics (to be confirmed over the coming months).

As Federal Reserve Chairman Jerome Powell pointed out, growth remains strong and is expected to continue, given that it is largely due to a supply shock rather than a demand shock. Labour market participation rate is significant, strengthening the pool of potential consumers. Households remain confident in their ability to consume and invest, as illustrated by results from the Conference Board survey.

For the first time in sixteen months and thanks to a rebound in new orders, the manufacturing ISM14 returned to an expansion zone of 50.313 in March, versus 47.813 in February.

In this context, many Fed members seem inclined to wait before starting a cycle of lower rates. Inflation expectations are well entrenched, wages are moderate but disinflation remains very gradual at this stage, and the latest January/February figures have delayed the process. The end of the fall in energy prices, the robustness of rents and the inertia of prices in services constitute a brake. The rate-lowering scenario this year retains its majority at the Fed but looks slower than expected. To date, the implicit probability of a rate cut in June is around 50%15.

Eurozone: significant contrasts

The euro area has seen a very good trajectory of falling inflation since the beginning of the year. In France, inflation reached a level of 2.5%15 well below expectations, while Spain and Italy also experienced declines. We should benefit from positive baseline effects in the spring, achieving inflation targets of 2%15 in the second half of the year. That said, inflation in services, to which the ECB16 pays a great deal of attention, has remained stable at 4%15 year-on-year for the past five months. However, this is a lagging indicator. Current price increases simply reflect catch-up from past wage increases in labour-intensive sectors. High-frequency indicators, such as the wage tracking tool ‘Indeed’, suggest that wage pressures have peaked across the eurozone. Businesses’ sale-price prospects are normalising in a context of low demand, as evidenced by the price component of the latest surveys.

This decline in inflation is accompanied by a gain in purchasing power, driven by wage increases, as well as a slight rebound in the consumer confidence index. Nevertheless, consumption is not picking up for now, with households still preferring to direct their money towards savings.

In addition, manufacturing, particularly in Northern Europe and Germany, continues to drag. Germany is a sick man in Europe, especially compared to the countries of Southern Europe and, to a much lesser extent, France. Retail sales fell by 1.915 points monthly. The rebound in activity is hindered by political paralysis and a lack of investment. Tight control of debt levels comes at the expense of future investments. The contrast with the countries of Southern Europe, which benefit from structuring policies started after the 2012 crisis, will therefore continue. The predominance of services in the Iberian peninsula benefits its economy, and growth is not maintained at the cost of debt.

This explains the somewhat sluggish start to the year, but we believe that the situation is improving and that there should be a rebound from the second quarter, accelerating in the third. The Eurozone composite PMI17 was revised upward to 50.315 in March, its highest level in ten months. Among other things it highlights a return of growth for the private sector. A wide range of advanced indicators confirm this trend, and the reversal of the stock cycle suggests a gradual manufacturing recovery. Finally, the more pronounced disinflation in Europe compared to the United States leaves greater latitude for the European Central Bank compared to the Federal Reserve to relax its monetary policy. The ECB is expected to be able to cut rates by June.

Debt, an Achilles heel for France?

France’s deficit was announced at 5.5%15 last month, compared to 4.9%15 expected. France’s current deficits are increasing debt-to-GDP ratios, with debt now approaching 112%15 of said GDP. Until now, the repercussions have been limited because the refinancing rate of states, including France, was lower than nominal growth (real growth + inflation). Thus Italy, despite heavy deficits of 8.615 points of GDP in 2022 managed to reduce the burden of its post-covid debt from 140% to 137%15 of GDP. Such mechanisms are nevertheless undermined as the average refinancing rate of these states increases, in line with the rise in interest rates of recent quarters. Debt servicing, in France and other European countries, could therefore become a problematic issue, with almost 300 billion euros to raise on the markets in 2024.

On the evening of Friday, April 26th, the agencies Moody's and Fitch will deliver their verdict on French debt. The government fears bad news from Moody's, which, unlike Fitch, did not downgrade the country’s rating last year. In recent weeks, spreads between French and German sovereign bonds have slightly deviated but remain well below their October levels. In that they resemble spreads all across the euro area, indicating (still) a serene climate.

Indeed, from a technical point of view, French sovereigns are enjoying an ideal environment. Abundant, they serve as a substitute for German and Dutch securities. It therefore seems unlikely that a deterioration of the French rating would cause a panic, unlike a rating change in Italy, for example, which would have much stronger implications because its reclassification from ‘Investment Grade’ to ‘High Yield’ would prompt massive forced sales.

In the medium or long term, on the other hand, the slow deterioration of French public finances will eventually become a major topic. The good news lies in the substantial pool of potential savings that could take place without cutting too much growth, but of course, none of these would be politically neutral, making this an issue the country’s leaders are reluctant to address.

A specific risk still hangs over China

No haste for Central Banks

In light of the strength of the US economy, particularly in terms of employment, and given the latest inflation figures, the Fed will take its decisions meeting-by-meeting, without haste, according to the indicators. The healthy condition of the US economy buys the Fed time to act with deliberation. Jerome Powell also ruled out one of the rate cuts anticipated by the market for 2025. Our central scenario now is that of a first rate cut in September, followed by another in December after the elections. Uncertainty remains as to whether the cuts will continue in 2025. At the same time, it will be necessary to closely scrutinise the trajectory of US debt, which is both growing at a very fast pace and much commented on. However, continued productivity gains should, at least in theory, allow these to be absorbed.

For the euro area, our central scenario includes three or four rate cuts this year because we have maintained, since early 2023, that growth rebound capacities appear less than in the United States. Also, we must factor in a moribund real estate market. Recent disinflation momentum increases the likelihood of a first reduction in June, i.e. before the Fed, followed by a second in September.

We believe that the Bank of England will also undertake a first rate cut in June, probably followed by a second one this year. In the United Kingdom, inflation, which has been very strong and accentuated by the effects of Brexit, has declined considerably albeit at a slower pace now. Activity is resuming and real growth is outstripping those of France and Germany. As a reminder, the BoE18 was the first to raise rates, even before the Fed. Such pragmatism should still play.

To conclude, barring exogenous shocks, such as a rapid intensification of the conflict between Russia and Ukraine – which is expected to enter a crucial phase by the end of the summer – or too strong a rebound in oil, macro and microeconomic dynamics reinforce our scenario of a successful soft landing for the global economy, driven by US growth which should remain above potential for the entire year and European growth in the rebound phase over the coming quarters following a rather weak start to the year.

THE LONG VIEW

L’OTAN19, an instrument of protection... for European public debts ?

Donald Trump has done it again, hinting once more that he is considering withdrawing the United States from the North Atlantic Treaty Organization (NATO), and prompting much comment and concern in Europe. Such an outcome seems unlikely to us, but Mr. Trump’s remarks come as Russia is taking the initiative in Ukraine, exacerbating anxieties. During his tenure, he previously demanded that Germany compensate the United States for all or part of the military protection it was granted through NATO 20. German leaders got a taste of the process, before yielding and increasing the country’s contribution to the budget of the organization to levels commensurate with Washington’s. The $10 bn purchase of 35 F-35 Lightning II by Berlin in 2022 also served as a sort of a pledge to the Biden administration. Even some Democrats now seem more cautious about NATO, and recent departures from the State Department do nothing to contradict the trend, at least for the time being.

Without predicting Mr. Trump’s real intentions were he to regain the White House, intentions most likely destined to set the terms of future negotiations, it is an interesting exercise to take him at its word: what implications would a US withdrawal from NATO have?

America defends Europe, which defends its social model

A simple and longstanding thesis hangs over Europe: namely, that thanks to NATO, Europe has reduced its defense budgets devoting them de facto to its social model. After all, the fall of the USSR removed the most immediate threat to the old continent, while US military bases ensured its security. While the version shared by Trump’s advisers is a caricature, the budgets of various European countries do not really deny the underlying premise. Of the 32 members of the Alliance, only 11, including the United States, devote at least 2%21of GDP to defense, a threshold that states committed to respect in 2014.

Since NATO has constantly evolved since its creation, with the inclusion of new members, the disappearance of its most important objectives in favour of new missions, the reallocation of its resources, partly taken from the national armies of its members, there is no method to quantify the full scope of the role it fulfils. The €3.3bn of its official budget certainly does not reflect it. Data provide a better illustration: 60,000 US troops stationed on the old continent, for the most part in Germany, in Italy, in the United Kingdom and Spain; the US defense budget of $860bn (excluding veterans), represents almost three times the cumulative defense budgets of other NATO members and has synergy effects from which Europe benefits. NATO’s own nuclear deterrence depends entirely on US means, even if British or even French nuclear forces, more autonomous for the latter, may be incorporated into an employment framework of the Organization if necessary. These contributions must be added to others, which are difficult to quantify but all crucial. In this regard, the conflict in Ukraine offers valuable lessons on the quality and depth of US military intelligence, which is unparalleled. The discovery of the terrifying operational potential of drones coordinated using data provided by US observations gives a sense of the Alliance’s deterrent power in a conflict. If the Ukrainian armed forces have put up a more effective than anticipated resistance to the Russian offensive, clearly undersized in view of the war aims as we understand them and as they became following the failure of negotiations in March 2022, this comes in particular from the amount and precision of information provided by the United States. This made it possible to anticipate Russian movements, locate their resources and render them inoperative, often at a lower economic cost than in past conflicts. Even today, despite the lack of ammunition or even Ukrainian personnel, North American intelligence is hindering the initiatives of Russian troops, who can exploit any success they achieve only very slowly, with significant losses, hence the absence of breakthrough despite taking key positions on a highly extended frontline where there is no choice but to scatter the forces.

Budgets, nuclear deterrence, quality of materials, men, communications and intelligence: this is what the United States brings to Europe for its security, and which would have to be replaced if for some reason, they withdrew from NATO. What would this cost?

$350bn per year to be found?

Let us imagine, therefore, that the American contribution must be declared forfeit and resources allocated to an alternate system of defense. If defence budgets were increased to the 2%22of GDP due in theory, the total would amount to $75bn for the 17 European countries, excluding Turkey, that fail to meet this criterion today. Nothing insurmountable a priori. However, these 2%22 form actually a minimum starting point, because compensating for the withdrawal of the United States would instead claim closer to 3.5%22 of the GDP on the United States respect. In such a case, the addition would amount to nearly $350bn to be found per year, including about $80bn annually from Germany and $50bn each from France and Italy. However, these countries are looking to lighten their budgets, not inflate them. As it stands, governments do not have the economic means for such fiscal expansion in a period of rates around 2.5%, 3% and 3.8%22 for the 10-year Bund, OAT23 and BTP24 respectively, while the accelerated ageing of their populations induces significant social transfers at a time when their indebtedness (particularly in the French and Italian cases) hinders them. France and the United Kingdom would each have 1.5%22 more GDP expenditure to finance each year, Germany, Italy and the Netherlands about 2%22 and Spain or Belgium 2.2%22 at the very least.

Of course, certain factors would partially mitigate these deleterious effects because it is necessary to take benefits into account as well. The NATO standard currently involves the use of equipment supplied the US defense industry. The F-35s mentioned above offer a case study for penetration of the European market by US companies in the name of strategic coordination. This stealth multi-role jetfighter, developed primarily by Lockheed-Martin, is required equipment for the United Kingdom, Italy, Denmark, Netherlands, Norway, Belgium, Switzerland, Finland and Germany. Although there are some benefits, at least officially, for BAe Systems, Finmeccanica and other EU firms, they remain limited. Meanwhile, the spread of this aircraft in Europe stifles European fighter development programs. With the United States outside NATO, Europe would unshackle itself from this dependence, free to establish a clean industry, scattered elements of which it retains, although they are minimal compared to the bloc consisting of Boeing, Northrop Grumman, General Dynamics, Huntington Ingalls and others. Although Mirova does not claim to master the arcana of this particular sector, in which we do not invest, we know the effects of this on technology and the industrial footprint formed by producers and subcontractors. We also know that this would require the patient reconstitution of an entire sector over at least ten years.

Source: OTAN

Conclusion: The Atlantic divergence; tensions over government debt

We have insisted since at least the end of 2022 on the divergence, and notably the economic divergence, between Europe and North America, illustrated in the gap between the 10-year T-note and the Bund, whose correlation has been falling for a decade. A military uncoupling, which would also entail diplomatic and political ruptures, would further exacerbate the distance. This is especially true in terms of budgetary challenges for European countries whose social systems, already stretched by demographic trends, would be subject to reforms difficult to accept for populations who, having paid in to the system, expect to benefit from it. Ultimately, a more autonomous Europe would be doomed to re-converge its economy towards the American model, which it has uncoupled from since the crisis of 2008, when the two zones’ GDPs were still equivalent. The path could prove painful, although for a shorter period than politicians fear.

Paradoxically, while we do not believe in the prospect of a total withdrawal of the United States from NATO, as it would harm their interests, it seems plausible that the next resident of the White House, Republican or Democrat, will demand more effort on the part of European partners. This will only add to tensions over the sovereign debt of certain states. With higher rates the norm and deficits resistant to shrinkage, deficits that, in a best case scenario, would have to absorb half a GDP percentage point of additional defense spending, with benefits only in the longer term, European countries are exposed to the risk of financial markets asking a higher premium to refinance their public debts. The equation Mr. Trump would set up, if he followed through on his threat, would be solved by further rate increases, something Europe does not need that right now.

1Past performances do not anticipate the future performances.

2Stock market index based on 500 large companies listed on stock exchanges in the United States

3 Source: Bloomberg

4Stock market index for Tokyo Stock Exchange

5Artificial intelligence

6Consists of selecting discounted shares, whose price is lower than their intrinsic value, in hopes that a revaluation will correct this market anomaly when investors rediscover their merit.

7Spread is the difference between the two prices of an asset in the financial sector (bid and ask). On the one hand we have the price buyers are prepared to pay, and that at which the security is offered.

8High yield

9Brent is a type of crude oil used as a standard for crude pricing and as a raw material for oil futures. Brent serves as a price reference for oil from Europe, Africa and the Middle East.

10West Texas Intermediate

11Core inflation is inflation from which some fluctuating elements have been removed

12Real-time Estimate Model of U.S. Gross Domestic Product (GDP) Developed by the Federal Reserve Bank of Atlanta

13Source: Bloomberg

14Economic indicator that measures the level of activity of manufacturers in the United States

15Source: Bloomberg

16European Central Bank

17The PMI provides advanced insights into the current state of the private sector from tracking variables such as activity, new business, employment and prices

18Bank of England

19Noth Atlantic Treaty Organization

20 https://www.nytimes.com/2024/02/15/us/politics/trump-nato-threat.html?smid=url-share

21Source: Bloomberg

22Source: Bloomberg

23Similar French Treasury bonds

24Similar Italian Treasury bonds

24. Spread is the difference or difference between the two prices of an asset in the financial sector. On the one hand we have the value of the purchase and on the other we have the selling price.

25. The Trading Range is a relevant indicator of the market especially for stochastic indicators.

26. A period when economic growth slows down, but the economy does not enter recession

27. the changing of the price, value, etc. of something

28. Profit per share

29. US Federal Bank

30. Interest rates are falling, and the yield curve is more inclined.

31. European Central Bank

The data presented reflect Mirova’s opinion and the situation at the date of this document and may change without notice. Any securities mentioned in this document are cited for illustrative purposes only and in no way constitute investment advice, a recommendation or solicitation for purchase or sale.