Mirovα, Creating Sustainable Value - June 2024

Monthly market review and outlook

A month at two speeds

In May, the equity markets recovered what they had lost in April and set new records in Europe and the United States. Investors warmly welcomed confirmation of the soft landing scenario for the US economy, against a backdrop of better-than-expected corporate results overall. However, these performances mask a month of contrasts, marked in particular by a series of hawkish1 speeches by a number of central bankers in the second half of the year.

In the first half, risky assets performed very well, buoyed by statements from Jerome Powell, who seemed to confirm that the Federal Reserve would not raise rates again. It also announced that it was slowing down its quantitative tightening programme. Fears that the US economy might be overheating were allayed by a slowdown in the number of jobs created - to 175,000, the lowest figure for six months - and by a slowdown in inflation - the lowest figure for 6 months - and by a slowdown in inflation. The monthly rise in CPI inflation2 for April was 0.30%3, below expectations and down on the 0.4%3 recorded at the start of the year.

This normalisation of the US situation has encouraged other central banks to continue cutting rates, with the Swedish central bank having already done so. This outlook was reflected in interest rates, with the US 10-year Treasury Bond falling to 4.34%3 on 15 May from 4.68%3 at the end of April, in line with a goldilocks scenario.

However, the trend reversed in the middle of the month. Several US central bankers, such as Christopher Waller, have issued statements in favour of extending restrictive monetary policy, the famous "higher for longer" approach. In the FOMC4 report, some bankers considered that the conditions necessary for a rate cut had clearly not been met, in particular a fall in inflation over three successive months or a significant weakening in the employment market. Following these statements, US interest rates rose again.

In Europe, the news was positive, with flash PMIs5, well above 50, at 12-month highs. At the same time, wage inflation data for the first quarter released by the ECB6 came out at 4.7%3 year-on-year, whereas the market was expecting 4.5%3. This figure, up on the previous quarter, fuelled fears of wage inflation, and therefore service inflation, which could slow the ECB's desire to cut rates. Moreover, underlying inflation came out at 2.9%3 year-on-year, a level still considered too high in relation to the ECB's target.

As in the United States, rates also rose sharply in the eurozone, this time on the basis of macroeconomic data rather than statements. This put pressure on equities and led to a sell-off in bonds. Market expectations of ECB rate cuts over 2024 fell back to 55 basis points at the end of the month, wiping out a rate cut in a week.

On the equity markets, the S&P5007ended the month with a gain of 5%3, the EuroStoxx 6008 3.5%3, while the Japanese market remained stable. In the United States, the Magnificent 7 continued their upward trend, up 9%3 over the month, including 27%3 for Nvidia alone after excellent results. The company's market capitalisation is now approaching $3,000 billion, bringing it closer to Microsoft and Apple.

Over the month as a whole, sovereign bonds were down, particularly in Europe.

The credit market saw record issuance volumes in May, which the market absorbed without difficulty and without any widening effect on credit spreads. This unexpected movement can be seen as an opportunity investment ahead of the US elections. Spreads are continuing to narrow and yields are still attractive. For some players, particularly insurers, credit therefore remains an attractive carry option.

Over the month, oil fell by 7%3 and the dollar lost 1.5%3 against a basket of world currencies.

Graph of the month:

Macro review and outlook

Macroeconomics: appreciating good news

With overall growth of 3%9, the global economy currently appears to be operating at its full potential. The European Union is reporting good news, the United States has confirmed its soft landing, and Japan and China are showing resilience. The strength of the services sector offset the weakness of the manufacturing sector. The lagged effects of central banks' monetary policies are beginning to be felt, particularly across the Atlantic. As a result, inflation is slowing, even though it remains above central bank targets. But while the economic situation seems to be relatively clear, political/geopolitical uncertainties and risks are increasing.

United States: Consumption running out of steam; soft landing still the order of the day

The US released a few disappointing publications in May, with the ISM manufacturing index remaining below the 50-point threshold9, at 48.79. In particular, the "new orders" component is struggling the most, hitting a one-year low of 45.49 points. The second estimate of first-quarter GDP10 came in at 1.3%9, with a downward revision to the consumption component.

On the consumer side, the first signs of fragility are appearing in the United States, affecting a specific category of the population: low-income consumers. They suffered from residual inflation in the first quarter and default rates on credit (credit cards, car loans) are starting to rise, while their savings reserves built up during the pandemic have completely disappeared. At this stage, this is not enough to thwart the soft landing scenario for the United States that we adopted many months ago. Aggregate consumption by high-income households remains very high, and wealth effects counteract those of inflation. Retail sales are therefore still solid and growth should deliver its potential in the second quarter, especially as disinflation will provide relief for low-income consumers. To put it plainly: part of the population is starting to fall behind, without eroding the very satisfactory overall picture.

As far as the employment market is concerned, it appears to be neither too hot nor too cold, and seems to have returned to its pre-Covid equilibrium, if we are to believe the ratio of job vacancies to the number of unemployed, now equal to 1.2 vs. 29 by 2022, or if we look at the monthly average of job creations according to the business and household surveys (see this month's graph showing changes in the payroll and household surveys).

Admittedly, the latest payroll figure came as a clear surprise, with no fewer than 275,000 jobs created in May, but this needs to be put into perspective, taking into account seasonal effects, the household survey, the slight rise in the unemployment rate and the continuing fall in the rate of resignations. It calls for a normalisation of the labour market and wage inflation, and this is a very good leading indicator.

Eurozone: everyone is looking at savings reserves

The growth outlook for the eurozone is improving, and should reach less than 1%11 for 2024 as a whole, accelerating in the second half of the year. In the first three months of the year, foreign demand stimulated growth and, in the short term, we do not expect exports to fall back. German industry is a major producer of energy-intensive and capital-intensive intermediate goods that is sensitive to interest rates. Lower energy costs, the end of destocking, buoyant world trade and future rate cuts by the ECB should support activity, although there are risks inherent in the Trump presidency and its plans to introduce or increase import taxes.

Growth could therefore come as a positive surprise, thanks to the return of the German engine that we have been expecting for many months, even if this is primarily a cyclical rather than a structural rebound. Germany's problems of loss of competitiveness remain. They will have to be offset by a substantial budget reserve, but this will probably not be done before the next federal elections in 2025, given the strong political obstacles that remain, particularly following the recent European elections (see below).

Another positive point is that Europeans are benefiting from the strength of the job market. The unemployment rate has never been so low in Europe since the creation of the single currency, and this should support consumption, especially as real incomes and consumer confidence have risen sharply since the start of the year.

It therefore seems desirable, and possible, for the EU to find new sources of growth. Europe's very high savings rate could provide the fuel for this, or at least that is the political will of some countries, notably France. The EU is scrutinising the use of these savings all the more closely because - like the United States - it is facing a rise in its budgetary spending. These will have to finance defence and transition, and will add to the already high national deficits. Such a policy could also fuel inflation and put the brakes on the ECB's monetary easing. Emmanuel Macron and Olaf Scholz therefore want to direct the savings of Europeans towards the recovery of the EU, its transition and its growth - and in any case not just to support those of the United States or Asia.

Growth and inflation, always the stakes of the ECB

After a quarter-on-quarter rise in GDP of 0.3%11 in the first quarter, we expect a similar increase in the second and third quarters before activity accelerates at the end of the year and next year.

In line with expectations, the ECB cut its key rates by 25bp11 at its meeting at the beginning of June, without providing any further information on the path and timing of future cuts. It will reassess the situation meeting by meeting, insisting on its "data dependent" approach, with a particular focus on wage inflation.

We do not expect inflation to pick up in the second half of the year. Admittedly, wage growth was high in the first quarter, at 4.7%11 compared with 4.5%11 expected. But this is partly explained by the payment of exceptional bonuses in Germany. According to the recruitment website Indeed's advanced data, negotiated wages are actually falling, which suggests that the ECB is loosening its policy.

Following the first rate cut at the beginning of June, the ECB could cut rates again in September. A third fall in December will depend in particular on the budgetary policies adopted, particularly in France and Italy, as well as the outcome of the US elections, and we expect the terminal rate to be between 2.5%11 and 3%11 at the end of 2025.

Alongside these rate cuts, we could see productivity gains in Europe between now and the end of the year. There has in fact been more recruitment than necessary since the end of covid, particularly given the weakness of growth. This high rate of recruitment could now bear fruit and enable companies to increase their productivity.

Beyond the economy: global tensions, local tensions

Although the economic trajectory is becoming clearer, the level of uncertainty has nonetheless increased considerably, with the conflict between Ukraine and Russia still raging, and with the crucial elections in France, the UK, the USA and even India moving step by step into the unknown.

Europe, Asia, the Middle East: escalating into the unknown

The decision by Presidents Emmanuel Macron and Joe Biden and Prime Minister Rishi Sunak to authorise strikes on Russian soil using long-range missiles supplied by France, the United States or the United Kingdom marks a major escalation in the eyes of the Russian authorities. They consider that the use of such weapons will inevitably require the direct involvement of military resources, including satellite and human resources, from the countries that grant them. Shortly after Ukrainian forces targeted the Voronezh DM early warning radars, a key element in Russia's deterrent system, this growing involvement of NATO's three nuclear powers could lead humanity into a great leap into the unknown. All this raises the level of threat to an unprecedented threshold, in a climate of relative indifference.

At the same time, Iran is fast approaching nuclear power status, while China has been increasingly aggressive towards Taiwan, systematically crossing red lines for several weeks.

In the Middle East, the results of Biden's peace plan are still awaited, but we can note the desire of the American President, no doubt also guided by his electoral interests, to move the issue forward on the international stage after his initial procrastination, which ended up causing incomprehension on all sides. We believe that the State Department will need to be more insistent to achieve its aims.

This high-risk global context appears to be inflationary, not least because it is inevitably pushing governments to increase their defence spending. The potential for conflict in Asia is also leading Western countries to accelerate reshoring, the famous repatriation of their productive activities to their homelands or to friendlier countries. this will inevitably harm world trade, and at a high cost. In the short term, this political and geopolitical uncertainty is interfering with inflation expectations by maintaining upward pressure (on oil, commodities, the budget deficit, etc.), but if armed conflict were to become widespread, this would initially push long-term rates down.

Votes confusion

Tension surrounding the US elections will now rise as the campaign enters a more active phase in June. The first televised debate between the Republican and Democratic candidates will take place on the 27th. Then, two weeks later, Donald Trump will be told exactly what sentence he faces. This adds fuel to an already explosive situation, which could increase social tensions in the United States. Until the elections, the causes of stress will multiply and generate a great deal of uncertainty, and this at a time when the US markets have reached their all-time highs.

Whoever wins in Washington, budgetary slippage is to be expected. Republican policies on tariffs and immigration, for example, could have inflationary effects, as could, to a lesser extent, Democratic policies via fiscal stimulus packages. Given that the trajectory of the US deficit is already a cause for concern, and that the United States' natural creditors are becoming increasingly scarce as a result of international tensions, the prospect of strong rate cuts is unlikely.

In the EU, the elections have delivered their verdicts, with far-right or very conservative parties obtaining good results in Italy, Hungary, France, Austria and Germany, where Chancellor Scholz's SPD recorded a notable underperformance, finishing behind the CDU and the AfD, which will weaken it at a time when the European Union would on the contrary need a Germany in working order.

The French case is also attracting market attention. Following the results of the European elections, the President of the French Republic took the decision to dissolve the National Assembly, thus causing early parliamentary elections on 30 and 7 July. Concern is gaining the markets in the face of uncertainty generated by this unprecedented context, fearing the implementation of programs they consider too expensive, the potential emergence of social unrest depending on the nature of the electoral results, or a new political paralysis preventing the resolution of budgetary problems that becomes difficult to postpone further given the increasing weight of interests in public finances.

By contrast, the situation in the United Kingdom, which renews its House of Commons on 4 July, seems calmer: the Labour Party, widely expected to win, seems to want to move away from an economic vision that focuses entirely on international trade. The sequence of Brexit implementation measures, which four Conservative Prime Ministers have led, sometimes from very different angles, even conflicting in some respects, seems to be coming to an end with a certain serenity, while the country is undeniably experiencing a return to growth.

Finally, in India, Prime Minister Modi remains in power following the elections, as expected, albeit with a smaller lead than anticipated. Nevertheless, the relative stability brought about by Mr Modi's reappointment is good news for the markets, as India looks set to play a key pivotal role in international relations.

Are the risks rising? Risky assets too...

As the first half of the year draws to a close, we believe that the soft landing scenario for the US economy is still valid, but is now entering a less idyllic phase, with the working classes sadly, and understandably, affected by the resilience of inflation, which may be falling, but is still high compared with the levels of 2000 and 2010. Volatility is likely to increase on the markets, but there are still sub-trends on which to capture performance. In short, while economic trends in the second half of the year may have seemed easier to read, the political and geopolitical contexts are taking us into unknown territory, where anticipating the level of risk is an arduous exercise.

Indeed, the combination of tense electoral situations on both sides of the Atlantic and international relations of a degree of conflict not seen in the world since the Cuban missile crisis or even the Second World War seems to be creating one of those improbable situations that markets, by definition, find very difficult to value. Let's hope they don't have to, because the stakes obviously go far beyond the holding of a few indices... However, the situation does suggest a paradoxical hope, that such a strong conjunction of risk factors indicates that the climax has already passed its highs or is approaching them. Clearly, the worst is never certain..

The Long View

CoCos12: so sophisticated, and so useful

Symbols of the added complexity introduced by the Basel III and related regulatory frameworks, CoCos are sophisticated instruments that are very tricky to master. The moves over the past two weeks have illustrated this.As a result, these subordinated bonds, which have the nature of quasi-equity, as reflected in their designation as AT1 (Additional Tier 1), form an asset class that is as sought-after by some as it is decried by others. They are often associated with problems rather than remedies. And wrongly so. The recent split following the dissolution of the lower house of the French Parliament has done nothing to change this: this is a tool that needs to be handled with care, both when buying and selling.

That little 1.5% that makes all the difference: capital-intensive CoCos/AT1s!

AT1s are recognised as Core Tier 1 capital for regulatory purposes. They are therefore a form of simulated capital, convertible into shares or fully depreciated if (i) the point of non-viability is reached13 or trigger thresholds15 are breached and/or (ii) there is a prospect of bankruptcy, often linked to liquidity leaks or questions about asset quality, and vice versa. The use of CoCos/AT1 by a bank stems from a regulatory requirement to have an absorption cushion of 1.5%15 of risk-weighted assets (RWA). That's all it takes. The size of the CoCos/AT1 market therefore depends on bank balance sheets and remains predictable and limited.

CoCos/AT1, saviours of banking kolkhoze?

CoCos/AT1 are thus one of the first bulwarks against systematic risk, and they have already helped to avert many predicted disasters such as those at Banco Popular or Credit Suisse. Although these instruments are synonymous with market stress and high yields, they play a crucial role in ensuring the long-term viability of banking systems by making a major contribution to the (re)capitalisation movement that began in 2013 at a time when banks' business models were suffering the full impact of low interest rates. They are used, through bail-ins, to absorb losses in order to avoid having to dip into the revenues of taxpayers, who are themselves depositors. The idea is that if the bank fails, the private sector will have to pay the price, rather than governments having to bail out the banks as a last resort.

We are among those who believe that the instrument has only strengthened its credibility and saved the sector from many perils. The regulators' admittedly controversial decisions have done nothing less than resolve - in just one weekend (!) - crises that were shaping up to be systemic.

Since 2019, we have been modelling CoCos/AT1 to approximate their fair value, as well as corporate hybrids and Tier 2, the other main categories of subordinated debt, senior to CoCos/AT1. The parameters of our models are of a regulatory and fundamental nature: capital ratios, valuation multiples, type of conversion, comparison with Sub-Fin CDS, effective maturity, value of the redemption option, Texas ratio, etc. We compare CoCos/AT1 to HY B-rated bonds and discern a potential drop in yield of at least 0.5% 17(see below) at 1%17 delta (pre-Covid level).

According to our models, the excess return potential of CoCos/AT1 is among the best on the market, but their spreads still do not reflect the banks' renewed profitability. The current high level of capital generation by banks reduces the need to use these instruments in the short term.

CoCos/AT1 are one of the few asset classes that are expensive to sell in most market circumstances. However, we can expect occasional, brutal drops in performance, and the days after the 10th of June of this year provided an excellent illustration of this. Since 2013 to May 2024, the monthly performance has been 0.7%17, or more than 7%17 a year. Peaks of +8%17 in one month and -16%17 have occurred, especially in 2020.

At the same time, RWAs are not increasing enormously, as credit production has been relatively sluggish recently given the prohibitive level of interest rate rises and the tightening of credit conditions, which is leading to little CapEx, M&A, property purchases, etc. The ancestors of CoCos/AT1, which admittedly offered greater contractual security, with step-up/down18 for example, offered yield spreads of less than 100 basis points (bp) vs swap. Today, the figure is more like 420 bp. The 2008-2009 crisis has left many scars on management behaviour. A return to these levels seems unlikely, but an in-between scenario is highly conceivable. If we look at 2018, spreads were less tight then: 300bp vs swap seems well within reach provided the current tensions around France abate.

Artificially risky because of its “terms”

Regulators wanted CoCos/AT1 to offer maximum flexibility: "Subordinated junior debt (the riskiest debt of banks and the least senior), discretionary coupon subject to distribution rules (MDA19), perpetuity like shares but redeemable early, subject to "economic interest", a notion that nothing really specifies or defines. This lack of clarity has led to considerable volatility. Investors fear that their repayment will be delayed beyond the first scheduled date, as this will result in a loss of income. A longer holding period means a longer discounting period and a lower return over time.

Because of these specific features, CoCos have their own index. Specialised global investors have emerged, fuelling daily liquidity of almost €10bn of axes, 1.5x more than for the HY €, for 1.5x less outstandings (sample of 275 securities). The market is worth over €200 billion. Initially reserved for large European systematic banks, the instrument then spread to smaller institutions across Asia, the Middle East and Latin America.

The Santander case: the absurdity of the backend/reset spreads prism

Santander has a reputation as an issuer that is not very conducive to redeeming subordinated bonds, including CoCos/AT1s, which is a shame given that the bank bought Banco Popular after converting/offsetting CoCos/AT1s. However, against almost all expectations, Santander redeemed a CoCo/AT1 early. This was an early refinancing, with a premium of 3%, which was surprisingly generous for such pragmatic players. Market practice, as is also the case for private company hybrids and Tier 2s, is to consider that a CoCo/AT1 issued at a low yield, or rather at a low reset spread relative to the others, has less chance of being redeemed early. The exact opposite happened; the issuer repaid well in advance of the theoretical date of 2025. We believe that this risk of non-repayment/extension is overestimated. We have found that, in most cases, banks do pay back.

No CoCos without convictions

All of the above factors partly explain why, on balance, these instruments have been able to deliver profitable returns to investors in recent years, despite their volatility. By design contradictory in more ways than one - because of their dual nature as bonds and quasi-equities, because of their regulatory objectives which seem to contrast with their reputedly speculative use, and because of the behaviour of those who issue them when they recall them when nothing seems to oblige them to do so - CoCos occupy a very special place in the markets after years of prevarication on the part of investors.

For investors who know how to value them and use them wisely, they offer a fairly unique tool for managing the risk/return trade-off. There is a downside: in periods of risk off, you have to know how to get out of it, before getting back in when you need to. The good news is that their liquidity makes it easy to execute any need to reduce or increase CoCos positions. A conviction manager with a long-term view, which is what Mirova is, needs to know when to use it, and when not to.

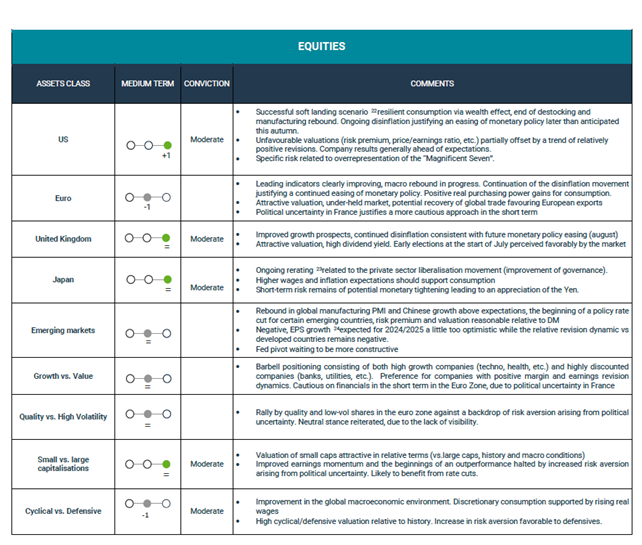

Summary Market Views

1 Hawkish refers to a stock market situation where interest rates keep rising

2 Consumer Price Index

3 Source: Bloomberg

4 Federal Open Market Committee

5 advanced indicator of economic growth, providing an overview of the direction of the manufacturing sector before the publication of official GDP figures

6 European Central Bank

7 Stock market index based on 500 large companies listed on stock exchanges in the United States

8 Stock market index composed of 600 of the main European market capitalisation

9 Source: Bloomberg

10 Gross domestic product

11 Source : Bloomberg

12 Cocos: Contingent convertibles

13 When a bank meets the conditions for triggering resolution proceedings or ceases to be viable if its own funds are not impaired

14 Automatic trigger threshold (contingent) for conversion set at 5.125%/7% of CET1. CET1: hard equity or share capital, restated retained earnings

15 Source: Bloomberg

16 HY for High Yield or High Yield in French refers to BB+ rating bonds and less

17 Source: Bloomberg

18 Coupon/interest readjustment mechanism (upwards or downwards) protecting investors from events such as non-repayment, rating downgrades, etc

19 restrictions on distributions of dividends, bonuses, CoCos/AT1 coupons based on capital cushion coverage.

20 Spread is the difference or difference between the two prices of an asset in the financial sector. On the one hand we have the value of the purchase and on the other we have the selling price.

21 The Trading Range is a relevant indicator of the market especially for stochastic indicators.

22 A period when economic growth slows down, but the economy does not enter recession

23 the changing of the price, value, etc. of something

24 Profit per share

The information given reflects Mirova's opinion and the situation at the date of this document and is subject to change without notice. All securities mentioned in this document are for illustrative purposes only and do not constitute investment advice, a recommendation or a solicitation to buy or sell.