Mirovα, Creating Sustainable Value - Listed assets - January 2024

Annual market review and outlook

2023: Highlights

Economic performance:

• Growth in the United States, outperforming expectations.

• Shift from stagflationary trends towards disinflation without recession in both the United States and eurozone from a worst case to a best-case scenario.

• Continued geopolitical instability, with less impact on the economy and markets than in 2022.

Resilience on the business side:

• American and European companies preserved their margins in a show of solidity.

• Strong productivity gains in the United States, thanks in particular to the digital and

technological transition, but also a buoyant rejuvenation of industrial foundations as a result of reindustrialisation.

• Tighter bank lending in the eurozone: an area of concern.

Employment and consumption:

• Solid job market in both the United States and Europe.

• Purchasing power and consumption sustained thanks to wage increases and budgetary support.

Markets and investment:

• Strong performance by equities and debt at the end of the year.

• Spectacular volatility on rates.

• Outperformance of US markets, driven by technology stocks versus European markets, grounded in less dynamic domestic economies than in North America.

2024: Highlights

Base case scenario:

• A soft landing for the economy without recession.

• Stabilisation of inflation between 2% and 2.5%.

• Central Banks cutting rates in the spring

• Stabilisation of productivity gains with resilient investment and consumption levels in the United States and, to a lower extent, in Europe.

Areas of concern:

• Ability of European companies to protect margins and jobs.

• Impact of regulatory changes in Europe and the United States.

• Geopolitical and electoral uncertainties.

Markets and investment:

• Market with no clear trend during the first part of the year, diversified multi- asset class allocation recommended, then risk asset rebound thereafter.

• Attractive outlook for US equities excluding the “Magnificent Seven”, small and mid-caps and some cyclical parts in Europe.

• Opportunities in ESG1 and impact finance, with the roll-out of plans to promote energy transition against a backdrop of short term interest rates have reached their peaks.

What’s in store for the Goldilocks scenario of late 2023?

Central scenario: a successful soft landing

Our base case scenario for 2024 remains that of a soft landing for the economy following the Goldilocks scenario combining disinflation and resilient growth that we adopted for 2023. We therefore expect growth to slow down on a global scale, but without falling into recession, and inflation to continue normalising towards central banks' targets.

This combination will make it possible both for workers to benefit from an increase in real wages and central banks to launch a cycle of rate cuts. Monetary easing should also help to reduce refinancing risk for companies over the next two years. We believe annualised global growth should slow over the next few quarters, heading towards 2.5% for 2024 as a whole, with 1.5% in the United States, 0.5% in Europe, where the start of the year will be sluggish, and 4.5% to 5% in China. Inflation, for its part, should recede to between 2% and 2.5% in the US and around 2% in Europe by the end of 2024.

Such a scenario calls for wage disinflation without job losses in order to maintain consumer confidence. The labour market will therefore play a key role in our expectations. Consequently, productivity gains will be one of the key variables to watch this year. This is especially true in the United States, where productivity gains rose sharply in 2023, even reaching an astonishing 5% in the third quarter2, and are expected to stabilise at around 2% annualised. While this may not sound like much, it is more than double the levels recorded over the 2000s and 2010s. By definition, productivity gains, if not too high, support margins and employment, making them the mainstay of growth potential over the next few years. Where do they come from? The rejuvenation of the US industrial base and the ever-wider spread of digital technologies.

Growth based on such factors does not in itself generate inflation, provided that energy prices do not soar; it can also absorb the rise in wage costs brought about by a shrinking workforce and the repa- triation of production capacity from China to the West. In the United States, inflation has plummeted from a peak of over 9% to less than 3.5% today3. Even in the hotel and leisure sector, where price increases tend to persist, inflation is slowing. On the wage front, labour supply and demand remain better balanced, with participation rates continuing to rise: the gap between job vacancies (labour demand) and the unemployed (labour supply) in the United States is narrowing, from over 6 million to just under 2.5 million today3.

In the eurozone, the situation appears more complex. Several survey data (PMI4, IFO5, etc.) are struggling to rebound, suggesting that the stagnation will continue, especially as productivity gains in the eurozone are not exhibiting the momentum seen in the US, far from that. Services remain in a zone of contraction, while manufacturing remains stable, albeit at very low levels. New orders and production indices reinforce this negative tone, falling sharply. Industry, on course for a fifth consecutive quarterly contraction, remains a weak spot in the short term. Nevertheless, as global inventory levels recover and demand improves, a rebound overthe course of 2024 is becoming increasingly likely. This would be a genuinely positive catalyst for European growth towards the end of 2024, as Europe, especially its Northern part, remains more exposed to manufacturing than many developed economies.

Meanwhile, investment will remain a drag due to factors such as the fall in housing investment and its impact on construction and the effects of rising interest rates on business spending. The construction industry alone accounts for almost 6% of European Union (EU) GDP. A 10% decrease in activity would cut growth by 0.6% and destroy many jobs, particularly in France and Germany6. However, in aggregate terms, the easing of financing conditions linked to the forthcoming change in monetary policy by the European Central Bank (ECB), coupled with the solidity of corporate balance sheets, should ensure that capex can be maintained in 2024 and 2025. The budgets earmarked for NextGenEU7 strategic plans, only 20%-30% of which have been used to date, could provide further support8.

Finally, even if job creation slows in the coming months, current levels combined with disinflation will support private consumption over the next few quarters, especially if European households spend even a small part of their savings reserves, which are at an all-time high.

Alternative scenarios, for better... and worse

The best: a non-inflationary ‘no landing’

If the Goldilocks scenario were to continue, there would be no slowdown in the economy, and we would find ourselves with the prospect of a ‘no landing’ situation. In this case we would see continued productivity gains and re-industrialisation in the United States, accompanied by job creation in parallel with a fall in interest rates that would not, however, be lasting. Strong growth, full employment and an absence of inflation – with no external crisis factors – would fuel this extremely favourable environment. However, the forces of the global slowdown and strong geopolitical uncertainties, as well as a number of more circumstantial factors, notably the expiration of certain fiscal policies in the United States, weigh against the likelihood of this scenario materialising.

Worst case scenario: an inflationary ‘hard landing’ or ‘no landing’ scenario

The increase in productivity in the United States is a positive factor for the economy... as long as it is paired with the maintenance or creation of jobs. In fact – as many examples in economic history suggest – a sudden surge in productivity thanks to digital technology could under certain circumstances lead to massive job losses, affecting young graduates even in well-paid, skilled jobs. In the short term, spectacular producti- vity gains would boost margins and thus maintain the workforce, but these kinds of transitions can happen much more quickly than observers suspect. Another possibility affecting employment is that pressure on company margins could lead them to cut their wage cost base. This would penalise consumption.

The combination of the previous two scenarios – in other words, increased supply thanks to productivity gains destroying jobs and weakening demand, which ultimately restricts margins and thus leads to further job losses – could even trigger a prolonged crisis of overcapacity, the worst possible situation for a developed economy. Nonetheless, this storyline seems unlikely in the short term, not least because declining demographics in most industrial nations, including China, remain a shock absorber for unemployment.

Finally, we need to consider the prospect of an inflationary ‘no-landing’, i.e. continued growth, as envisaged in our optimistic scenario, but this time accompa- nied by inflationary pressures. The Fed would then be forced to raise rates again, which would sound like an admission of failure, more or less repeating the sequence of the late 1970s, when a lull in inflation gave way to a rapid rise. This too seems unlikely: our readers well know that, in our view, Jerome Powell has designed his policy specifically to avoid having to imitate Paul Volcker.

Our market and investment outlook

Take a break and start over

Given our scenario of a soft landing, disinflation and cuts to central bank interest rates starting in the spring, we believe it is worth investing in risky assets (equities and credit) this year. All the more so as these asset classes could benefit from the large sums currently in the money market – several trillion dollars – which are now likely to pour into the capital markets.

Equities: major trends set the tone

One of the key trends for equity markets in 2024 will be the resilience of the US economy. While most of the upside in 2023 was limited to the Magnificent Seven, we believe that sector leadership should extend beyond technology, with some parts of the coast still attractive in terms of valuation. In addition, US re-industrialisation is only just beginning, which should create opportunities as companies invest in new production sites and secure their supply chains. The US government has also made health one of its priorities.

In Europe, we believe that small- and mid-caps could participate to a greater extent in the upward rally over the coming quarters and thus generate outperformance. Even if, in the short term, the macro slowdown means we need to remain selective. Also, the valuation of certain cyclical sectors incorporates a prolonged stagflation9 scenario, which we feel is too negative given the disinflation underway and the macroeconomic rebound expected in the next 6-12 months. In our view, some cyclical stocks in the banking, property, industrial and consumer discretionary sectors will have a high upside by the end of 2024. Finally, countercyclical effects should be fully felt in Europe and be favourable to our ESG themes, particularly the environment and energy.

Fixed Income: understanding the new equilibria

As available savings shrink and investment needs remain high, a long term premium on interest rates develops. This new balance between diminishing savings and expanding investment will tend to limit the effects of key rate cuts and will invite a need to be attentive to the steepening of the yield curves. Disinflation will encourage a drop in short term rates, however keeping a close eye on long term rates becomes key, as resilient growth should limit their fall – and could even make them rise faster than what the market has in mind. It’s also wise to bear in mind that drawing down central banks' balance sheets will also play a part in this pageant, creating selling pressure on the long end of the curve. In terms of duration, we remain positioned on the decline of both short and long-term rates, and on a steepening of the curves. Note however that the fall in long-term rates, given the various forces at play, seems unlikely to be very sharp. This will affect the valuation of equities and stifle their potential to some extent.

Focus on ESG and impact

The theme of transition and impact finance performed very well between 2017 and 2021, before being put to the test in 2022 and 2023. Impact finance has now reached maturity and is fully understood and embraced by investors. In 2024, impact and transition finance will continue to benefit from government investment plans. Indeed, only 20 to 30% of the European Union's recovery plans have been deployed so far10. In terms of business sectors, this should particularly be to the advantage of renewable energies (solar, wind, hydrogen), energy efficiency, building renovation, water and waste management, and energy storage and distribution.

Conclusion

2023 defied market forecasts because, as we predicted a year ago, the world avoided the disaster scenario of a hard landing, even if the year was not without its challenges and unexpected events.

Could we be experiencing a period similar to that immediately following World War II (what the French call the Trente Glorieuses), which were partly attributable to a forced renewal of the American industrial base during the war, and then of the European industrial base following the war as part of the Marshall Plan?

Productivity gains combined with near-full employment are a reminder of this golden age, which also benefited from demographic dynamics that are now unattainable. The children of the Trente Glorieuses and their own offspring have not ensured the renewal of our populations. Our vision for 2024 therefore retains the optimism already expressed for 2023, bearing in mind, however, that political and above all geopolitical risks could change the situation and tip the world upside down at any moment, as several powers clearly want to test American tutelage, particularly on the monetary front, a sensitive area due to the yawning deficits racked up by both Trump and Biden administrations.

On the markets, this optimism was only felt in the last few weeks of 2023, and has already consumed a portion of theupside potential associated with lowering rates and a change in the tone of central banks against the backdrop of a soft landing of the economy. We recommend a balanced multi- asset position for the start of 2024, to be adjusted as events unfold over the course of the year, in particular changes to interest rates, the US elections and the situation in the Persian Gulf.

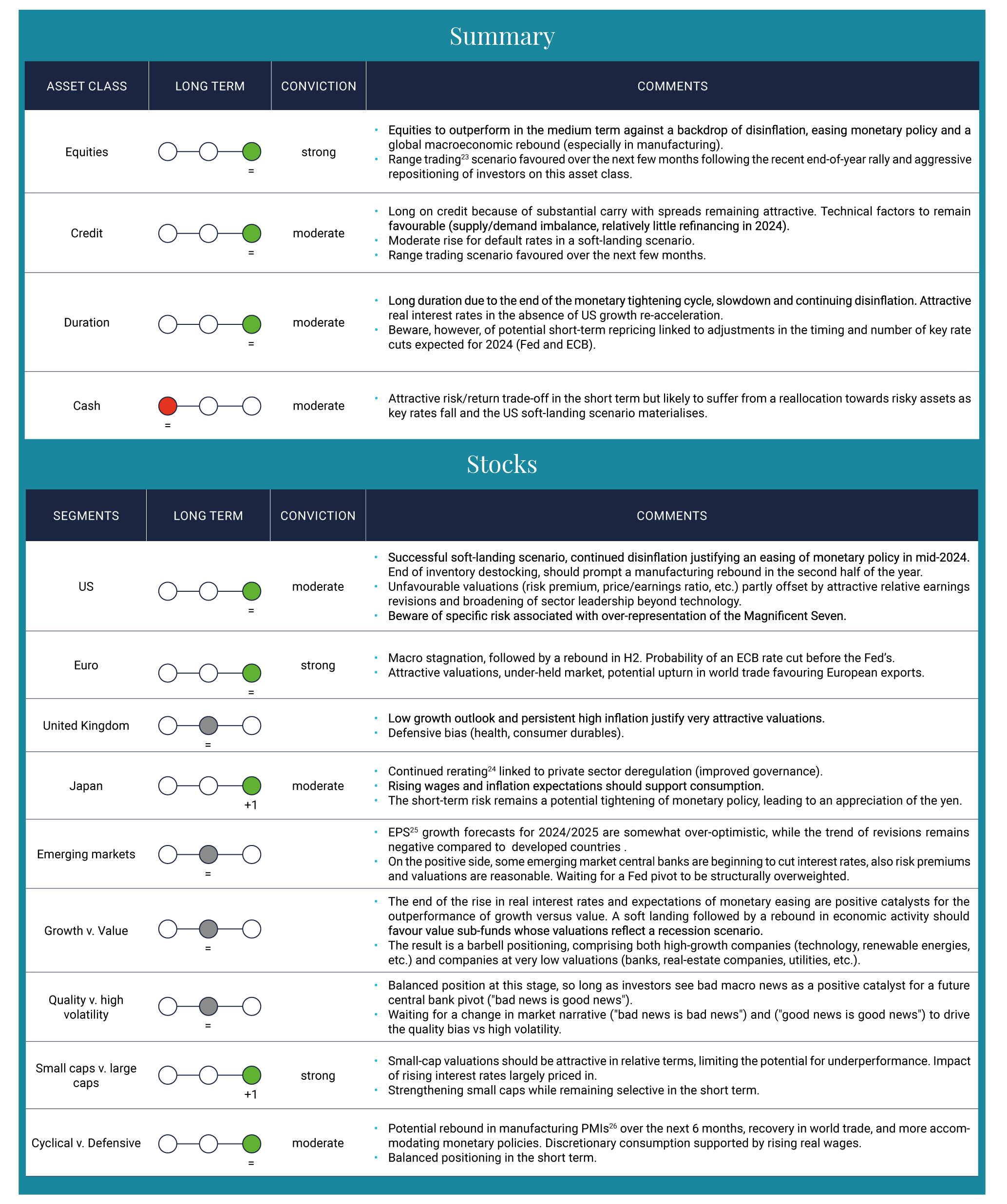

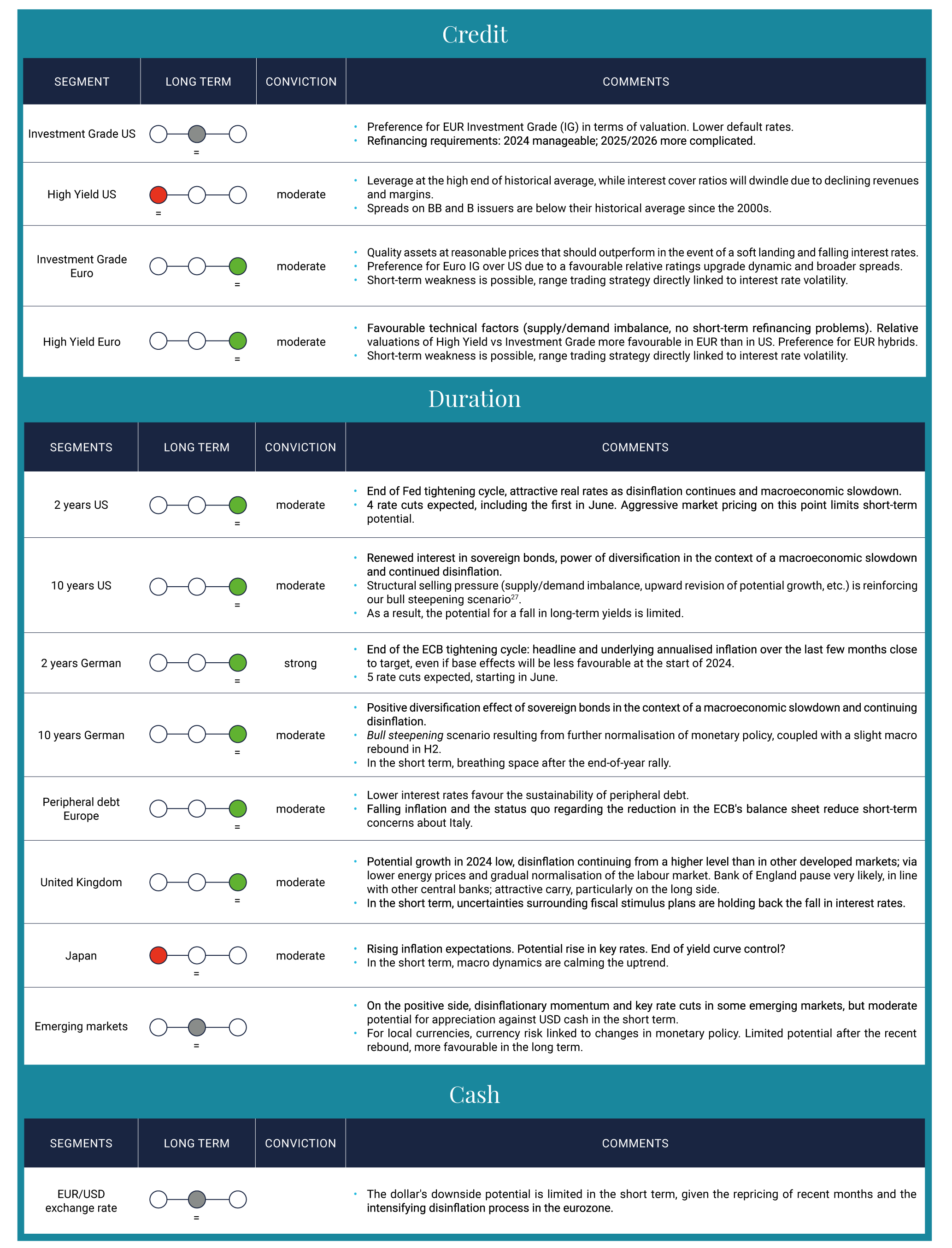

Market views Summary

1 ESG: Environmental, Social and Governance

2 Source: Bloomberg

3 Source : Bloomberg.

4 PMI (Purchasing Managers Index): Measure of the prevailing direction of economic trends in

manufacturing.

5 IFO (Information and Forschung): Evolution of economic conditions in Germany.

6 Source: Les Échos

7NextGenEU (NextGenerationEU): Europea

8Source: Les cahiers verts de l'économie.

9Stagflation: High inflation and low or no growth.

10Source : Bloomberg.

23Range trading : occurs when a security trades between constant high and low prices over a period of time.

24Rerating: Valuation of the new value of assets, following a major transaction.

25EPS: Earnings per Share.

26Manufacturing PMI (Purchasing Managers Index): Composite index showing the economic health of the manufacturing sector.

27Bull Steepening: Steepening of the curve by lowering short rates.

The data mentioned reflect Mirova’s opinion and the situation at the date of this document and are subject to change without notice. All securities mentioned in this document are for illustrative purposes only and do not constitute investment advice, recommendation or solicitation of purchase or sale.

OTHERS NEWS

Investing Insights from the Sustainable Equities Team

The Brief by the Energy Transition Infrastructure team