Mirovα, Creating Sustainable Value - February 2025

January

Indices ended the first month of the year at record highs, with a clear outperformance of European indices, which gained nearly 7%, compared to 3% for US indices. These gains do not necessarily reflect the succession of stressful episodes that investors had to manage throughout the month.

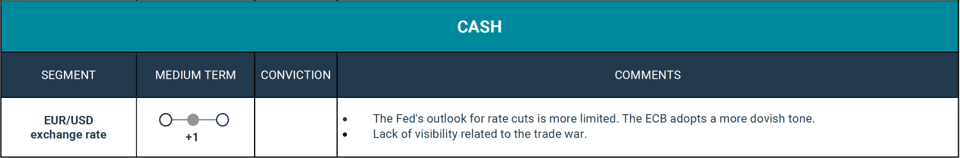

It all began with a sharp rise in US long-term rates, with the 10-year rate almost crossing the 4.8% threshold, due to the combination of good macroeconomic figures, particularly on the employment front, with fears regarding the effects of Donald Trump’s policies on rising prices and the trajectory of the US debt. It took the publication of lower-than-expected inflation to calm the market’s anxieties. This calm is undoubtedly temporary, since the issue is likely to continue to enliven markets for the rest of the year. European rates also rose during the month, essentially due to a contagion effect.

Chart of the month

The second wake-up call hit the US equity markets with the announcement of the release of the Chinese AI app, DeepSeek. This news caused Nvidia’s share price to fall by almost 17% in one session, representing a loss of almost $600 billion in market capitalization. During the same session, the Nasdaq fell by 3% and the S&P5001 by 2%. This is a reminder of how much the performance of the US markets depends on the theme of artificial intelligence. It drove most of the performance last year and is concentrated in a handful of stocks, the now famous Magnificent 7. This concentration makes the US indexes vulnerable to any bad news from these market leaders.

At the end of the month, macroeconomics and international relations took over, following Donald Trump’s shocking announcements regarding tariff increases. The surprise resulted from their scale and the speed with which they were applied: +25% for Canada and Mexico, +10% for China, for a value of affected goods of $1.3 trillion and this already during the first days of February. It nevertheless quickly became apparent that these announcements would mainly serve as leverage for negotiations with the countries in question, with Trump immediately declaring their suspension for one month, the time it would take to reach an agreement. This tariff policy nevertheless suggests that there will be future bouts of volatility, with future announcements in the pipeline that should next impact Europe.

On the commodities side, copper made a notable comeback, gaining 6% after 4 months of decline, while gold reached an all-time high of $2,880 an ounce, playing its role as a safe haven in this climate of uncertainty. Wholesale gas prices also rose in Europe. Reserves fell below last winter’s levels, with a season marked by cold spells. This upward trend in gas and electricity prices in Europe over the past several months could ultimately be detrimental, if it continues.

Regarding oil, the price of Brent2 rose 2% in January, after gaining almost 10% in the first two weeks. This increase raises questions about Donald Trump’s policy. Energy prices have risen globally by 25% to 30% since the end of his first term. His stated ambition is to lower them sharply, thus mitigating the inflationary effects of his trade policy on consumers. This is a strategy that, despite grand statements about increasing oil production, is likely to take some time. The US President nevertheless has two other deflationary levers up his sleeve: reduction of public spending and of State operating costs, as well as deregulation. Their effects will be awaited in the light of the President’s recent announcements on increases in customs tariffs, the real scale of which remains uncertain.

Macro review and outlook

A game that is harder to read

At the start of the year, a number of uncertainties are unsettling investors and, more broadly, the entire economic world. Between the technological war that is disrupting the game between China and the United States and Trump’s contradictory statements on trade policy, including with regard to his closest partners, changes of direction are accelerating.

With DeepSeek, global support for productivity

China’s structural difficulties evidently have not disappeared with the arrival of a new year, notably its demographic collapse, which is a long-term trend. The emergence of DeepSeek, an artificial intelligence (AI) system that is apparently effective and, above all, much less expensive than its US counterparts, nevertheless proves that the Asian giant still has real potential. This technological demonstration illustrates the innovative shift taken by the country, also observable with electric vehicles and batteries. This is enough to find new growth drivers and improve the attractiveness of China and its stock market in the short term, particularly relative to its US competitor.

The benefits of DeepSeek and future equivalents will not be confined to China. These tools point to productivity gains with a lower access cost, facilitating the spread of AI to all sectors of the economy. This could maintain a goldilocks3 scenario, with productivity gains fueling growth, while helping to lower inflation, particularly in areas lagging behind in terms of the adoption of these technologies, such as the European Union.

With the rapid spread of artificial intelligence, we believe that value creation should now focus on service innovations surrounding software, rather than on equipment and hardware. Conversely, this reveals a certain fragility in the US market, the performance of which remains highly dependent on the major hardware and semiconductor companies, led by Nvidia. The latent risk of disappointment is becoming real, with this highlighting the importance of prioritizing diversification in 2025. Sectoral diversification in the United States first of all, by integrating positions in the industrial, healthcare, consumer discretionary and financial sectors, then geographic diversification, by investing outside the United States, particularly in the European equity market, which is still under-owned, cheap and has the potential for agreeable surprises (recovery in consumption via an increase in real purchasing power and a fall in the savings rate, an accommodating ECB, a post-election recovery plan in Germany, a ceasefire in Ukraine, etc.).

Wealthy US consumers

High interest rates in the United States are not preventing many Americans from consuming, or even better, from consuming without necessarily resorting to credit. They are benefiting from a very positive wealth effect, relatively stable inflation for now and wage increases (4% annualized over the last 3 months). Real household incomes thus increased by 3% in the last quarter of 2024, compared with 1% in the second and third quarters. With consumption accounting for two-thirds of US GDP4, these figures demonstrate a certain potential for economic resilience in 2025. To this may be added a dynamic labor market and future tax cuts.

Companies also have significant capital reserves and are less sensitive to credit than they have been over the past 15 years. Lastly, more than consumers and businesses, it is the financial markets that are currently the most sensitive to interest rates and inflation, with the risk of a fall in asset prices leading to a negative wealth effect. Another point to watch is the scale of expulsions of illegal immigrants from the United States, which could generate a supply shock with a stagflationary5, or even recessionary effect in the longer term.

Increases in tariffs: a bluff or genuine threats to the economy and markets?

While the scenario is evolving in accordance with the statements of Donald Trump and his team, the increase in customs tariffs seems to be well underway, even if it means that they do not reach the levels suggested by the impetuous Trump administration. Unlike the President’s first term in office, this is primarily targeting its privileged trading partners. This will not be without consequences for US companies, whose supply chains often pass through Mexico, particularly in the automotive sector. Nor should it be forgotten that any retaliation would penalize exporting companies. This scenario does not appear to have been anticipated by American cyclical companies, which have benefited from the election result and remain at high valuation levels. Confirmation of the increase in customs tariffs with China and Mexico, currently postponed for a month, could lead to a relatively severe correction of the S&P 500 (at least 5%), costing a few tenths of a percentage point of growth in the United States, while generating at least half a percentage point of additional inflation.

In China or in the euro zone, US tariff policy, if limited to a general increase of 10% without any real response, would result in a contraction of GDP of a few tenths of a percent without a priori generating inflation. On the other hand, it could encourage the implementation of new stimulus plans. Overall, it should have a bearish effect on rates, especially short-term rates. In the United States, on the other hand, the stagflationary impact of such measures would lead to more of a wait-and-see stance by the Fed6, which should initially have rather a bullish effect on short rates.

EU hanging on the German elections

In the last quarter of 2024, Germany recorded growth of -0.2%, in a European Union stagnating at 0%. The parliamentary elections taking place this month are crucial to reviving an economic engine that Europe sorely needs. While the CDU-CSU7 has long been the front runner, with a campaign favoring the economy, business and an increase in indebtedness, the outcome of the election seems less certain since the same party has digressed on immigration-related issues in order to contain the AfD8. Which alliances will the CDU-CSU be forced to make in order to govern? Will it have enough power to lift the constitutional brake that is blocking the country’s level of indebtedness? A scenario similar to what France is experiencing, with a blocking minority wrested by the extremes, should be feared.

This would be all the more harmful, since Germany remains the European country with the richest households and the greatest budgetary leeway to initiate a recovery. Political stability is essential for a recovery in consumption and business investment, especially since companies are still favoring investment in the United States, to Europe’s detriment.

For its part, the ECB is keeping a close eye on the pace of disinflation and is satisfied to see service inflation finally fall below 4% on the back of wage moderation. Its objective is now to counteract the weakness in consumption and investments with the weapons at its disposal: we should see 3 or 4 rate cuts, reaching a terminal rate of 2% this summer; perhaps lower if European growth continues to weaken.

A year of Javier Milei: Libertarianism? – No need to rush

Has the Milei model hit the mark? Hold on a minute…

Three months ago, Javier Milei celebrated his first anniversary at the head of Argentina, to which he has applied a policy that deserves the often-overused term “authentically liberal” or even “libertarian”, with the exception of a few details of monetary policy. This policy has nevertheless achieved tangible results, albeit at the expense of certain sections of the population, as, moreover, was announced, but which, for the time being, are still giving him the benefit of the doubt.

This was enough for calls to replicate measures as radical as those chosen by the whimsical Argentine president to spring up here and there in the West, especially at a time when Elon Musk is making a strong case for reducing the US federal budget by $1 trillion, and no longer by $2 trillion as he previously trumpeted, while in the UK and France, concern is growing over levels of public debt. Whatever anyone thinks of Mr. Milei’s iconoclastic style, the measures he adopts are at least of interest, in that they offer the possibility of observing their favorable or deleterious effects and thus of drawing some lessons. Let’s not deprive ourselves of them.

Chainsaw massacre

No one can accuse Mr. Milei, who liked to show off holding up a chainsaw to indicate what he would do to the Argentine federal budget if his fellow citizens elected him to power, of not having announced in advance the measures he intended to implement. He is following his promised agenda. What did it consist of? Essentially, considerably reducing the scope of state action, with the rest of his political action stemming from this lever of advance action.

He has therefore abolished ministries, including the Ministry of Culture, which he considers the State has no business funding or influencing, the Ministry of Women, Gender and Biodiversity and the Ministry of the Environment, which we nevertheless consider to be an essential function and responsibility of the state, especially since Mr. Milei himself admits that “preserving our planet for future generations is a matter of common sense”. With regard to the Ministry of Health, he has imposed drastic cuts; lastly, he has merged others. He has also cut social budgets by 20%, warning that this would have adverse effects for around two years, and has slashed subsidies to businesses, again insisting that the state should not favor private actors. He also plans to privatize several companies, including YPF9, or to delegate public services, such as public transportation, to private operators.

He evidently proposes to deregulate, which is a corollary of any desire to reduce the influence of the state apparatus.

The targeted contraction of the state budget, which has fallen by almost a third at the federal level, allows for tax cuts, particularly tax on imports and transactions in dollars.

In itself, Mr. Milei’s approach is hardly original - does it not follow a logic already adopted, for example, by the Swedish government in the mid-1990s or by Mrs. Thatcher in the early 1980s? The common factor being that they came in the wake of a terminal crisis of disorderly state interventionism under the guise of Keynesianism. On the other hand, the scale of these measures makes it a rather unprecedented experiment.

Another surprising move: after carrying out a massive and relatively conventional devaluation of the peso, Mr Milei wanted to replace it with the US dollar. There is nothing very liberal about this in the context of open economies: entrusting the management of interest rates or even exchange rates to a foreign central bank runs the risk of depriving Argentina of the flexibility required for the inflation or growth differentials that are bound to occur over time. In view of the failures of the Peso-Dollar peg introduced from 1991 to 2002, and their astronomical cost to the Argentine economy after a few years of great success, as well as the lines usually defended by Mr. Milei, this part of his plan raises questions. It now seems that he is exploring the possibility of simply abandoning it, which in our opinion would have the merit of consistency.

What results has this policy achieved?

The results: falling deficits, rising vulnerability and encouraging signs

If Mr. Milei were to be credited with a victory, it would unquestionably be the speed with which he has reduced inflation in the country, despite the rapid devaluation of the Peso, without causing the economy to collapse any faster. From 211.4% in 2023, inflation fell back below 118% in 2024 with a now rapid inflection in time: in October, November and December, the rise in prices was below 3% per month. Admittedly, part of this reduction is mechanically due to austerity rather than to the consolidation of public finances alone, but the Argentinians seem to have found their way for the moment, so much so that curbing runaway inflation was becoming a consensual objective in all strata of society.

Another spectacular point, but not surprising given the scale of the cuts: a primary budget surplus of around 1% of GDP10 which Fitch and then Moody’s welcomed with rating upgrades for Argentina’s sovereign debt. As a result, the two agencies also raised their ratings for various companies in the country.

Lastly, the trade balance jumped to more than $18 billion in 2024, under the dual effect of the contraction of imports and the increase in exports, particularly of commodities. This last point seems less significant: Argentina has often posted this kind of surplus in recent decades, partly due to its dependence on agricultural production.

Mr. Milei therefore has some cause for satisfaction after a year in power, and just as many reasons for concern, since even if he had warned that precariousness would surge in the period immediately following the adoption of his first measures, the fact remains that he will have to reduce it. Time is running out: the poverty rate is close to 50%.

Lastly, most economic activity indicators, while encouraging, do not yet reveal any real momentum. Consumption is rebounding very slightly, industrial production is on a fairly weak recovery trajectory, and while real wages are finally recovering, it is important to remember their initial collapse at the arrival of Mr. Milei, who created a very favorable basis for comparison.

In view of all this data, 2025 could prove quite beneficial for the Argentine economy, with growth above 3%, federal deficits below 0.5% of GDP and primary surpluses around 1%, with rising production and employment feeding into wages and consumption. Even those with the greatest doubts regarding Mr. Milei can only rejoice for the Argentinians.

Libertarians 1 – Peronists 0

There’s no point in denying it: at this stage, the experiment constituted by the vigorous measures taken by Mr. Milei looks like a success, a very timid, if not fragile, success, but a success nonetheless. There is no indication that it will be prolonged because confidence in the Peso and the return of capital, without which no rebound will be sustainable, still do not seem assured despite the generous tax amnesties, which evidently were not enough.

Above all, no one knows the real cost that these measures will have on society; Mr. Milei, a candidate at the time, promised two years of suffering before finding a real way out of the rut: if precariousness does not diminish, his experiment will gradually turn into failure, one more for this country that briefly occupied the place of fourth world power almost a hundred years ago.

If, on the other hand, poverty rates finally fall and investment and consumption pick up again for several semesters in a row, then it will be necessary to recognize that the measures adopted in Argentina, despite their sometimes brutal nature - since eliminating jobs, even unproductive ones, remains brutal for those who held them and cannot satisfy any leader worthy of the name - have achieved their objectives. The fact remains that the problem with any experiment in economic policy does not change: it is carried out on human beings, not in a laboratory on guinea pigs; errors of judgment thus not only result in having to revise economic theories, but affect workers, children, pensioners…

Even if Mr. Milei were to meet with conclusive success, which we wish for the Argentinians, one question will remain: can his method be exported to other countries, as the Libertarians fantasize? Nothing seems less certain, since the Argentine context was an anomaly. Peronism and its more or less faithful avatars that shaped the country for 70 years had drifted towards a form of generalized clientelism, all against a backdrop of endemic corruption, having themselves exhausted the potential of the economy, notably by causing capital to flee to the United States, the United Kingdom, Uruguay or Chile. In a sense, if Mr. Milei can still count on the patience of the Argentinians, it is first of all because he warned them of the efforts he would ask of them, but also because they are aware that decades of more or less distorted Peronism could only lead to such a situation. In the same way, the British followed Mrs. Thatcher after the failures of the Labor Party, which was bogged down in stagflation. Liberals will no doubt believe that they can discern proof in Mr. Milei’s success of the effectiveness of their theories, when once again they will prove above all that correcting the excesses of a misguided social clientelism under the fallacious pretext of Keynesianism, which it betrays, can only remobilize economic agents and boost their productivity and investments.

Conclusion: Libertarianism, a team sport?

Paradoxically, the lesson of the Milei experience lies entirely in this, in that it has less to do with the economy than with politics: there is no effective economic recipe without a minimum of social consensus to support those who implement it. Charles de Gaulle, founder of the Fifth French Republic and not particularly given to excessive faith in the virtues of liberalism, had already demonstrated this when he presented the painful Rueff plan and a violent devaluation to turn around a country then in a very bad way. The French population had accepted it, not because they believed in Jacques Rueff’s theories, but because they had accepted that all social categories would have to contribute to it in roughly equivalent proportions. A few years later, it enjoyed a per capita GDP that was among the highest on the planet, close to that of the United States, in a country that was completely debt-free, and yet did not hesitate to resort to money creation if necessary.

Argentina is certainly not there yet, but if, by some chance, social cohesion remains stable, if trust between economic agents - a real flaw in Argentina for decades - and therefore in the Peso, which Mr. Milei negligently criticizes, returns, then the prospects for an ongoing revival would emerge.

At a time when Western societies are sometimes withering under the blows of growing inequality, which is fueling the emergence of so-called “populist” parties, drawing a lesson from Argentina could be beneficial. After all, they’ve got into the habit of giving us a lesson... in any case to the Dutch in 1978, the English and Germans in 1986, the Italians in 1990 and the French in 2022...

Summary of Market views

The information given reflects Mirova's opinion and the situation at the date of this document and is subject to change without notice. All securities mentioned in this document are for illustrative purposes only and do not constitute investment advice, a recommendation or a solicitation to buy or sell.

1 Standard & Poor’s 500: stock index based on 500 major corporations listed on US exchanges.

2 Global benchmark for oil prices.

3 Goldilocks Economy: A situation where economic growth is sufficiently good without being excessive (low inflation), avoiding a reaction from the central bank.

4 Gross domestic product: Total value of goods and services produced in a country during a given period, generally a year.

5 Combination of economic stagnation (low or zero growth) and high inflation.

6 The Central Bank of the United States.

7 The CDU-CSU is an alliance of conservative political parties in Germany, made up of the Christian Democratic Union and the Christian Social Union.

8 The AfD (Alternative für Deutschland) is a German far-right political party founded in 2013, which advocates nationalist and anti-immigration positions.

9 YPF, Yacimientos Petrolíferos Fiscales, is a company specialising in the exploitation, exploration, distillation, distribution and sale of oil and its derived products.

10 Total value of goods and services produced in a country during a given period, generally a year.

11 Investment strategy that allocates capital to both high-risk, high-reward assets and low-risk, stable investments while avoiding medium-risk assets.

12 Economic indicator that measures the health of the manufacturing sector of an economy.

Sources : Mirova, Bloomberg.

News

Discover the 2024 Impact Report for Mirova Global Green Bond Fund.

Investing Insights from the Sustainable Equities Team

Position Paper